Markets Daily

The Bank of England hiked 75bp but said markets were pricing in too much tightening. US yields rose further in the wake of the FOMC meeting, hurting equities and leaving AUD/USD lower at 0.6290. Today’s calendar includes the RBA Statement on Monetary Policy and Australia Q3 retail sales, then US October employment.

Yesterday

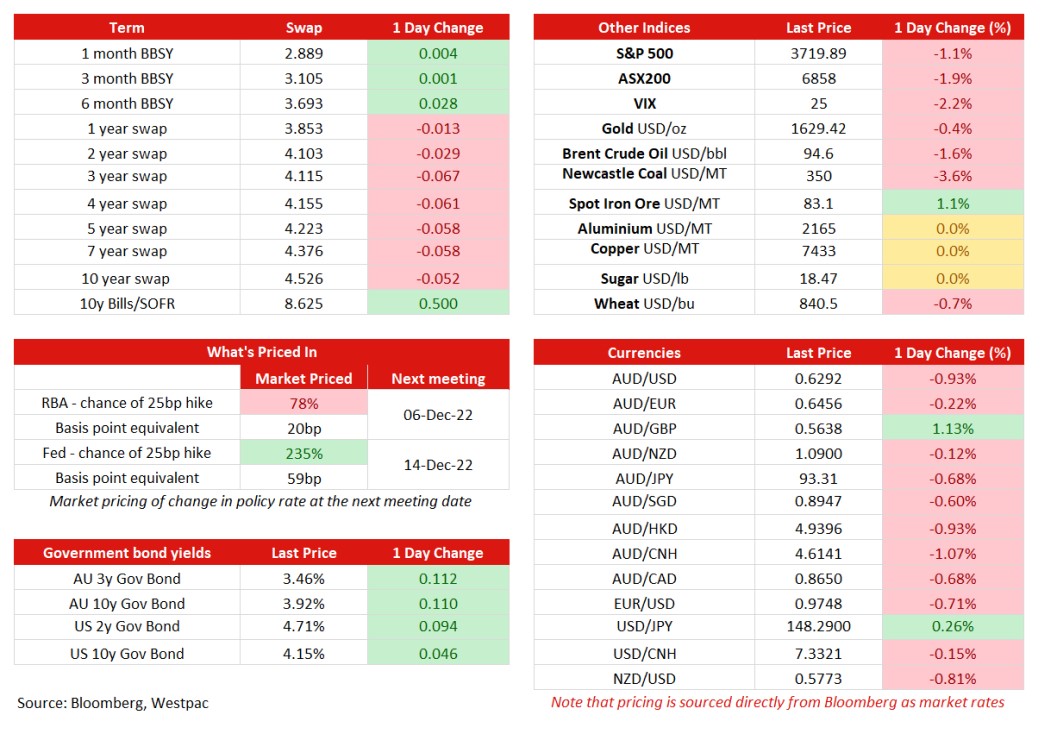

Australia’s trade surplus rose to $12.4bn in September from $8.7bn in August. Export earnings rose by 7.0% or +$4.0bn. Coal was down by only $0.1bn despite floods disrupting shipments. Fuels (dominated by LNG) rose by $1.8bn. Metal ores rose $1.2bn, on higher volumes. Service exports had another strong showing, up by 6.3%, $0.4bn, benefiting from the national border reopening. Imports were little changed, +0.4%, +$0.2bn. While there was a fall in consumption goods imports, the fuel import bill rose and civil aircraft imports were also up. Core imports (ex fuel, ex aircraft and ex gold) fell in the month, down by 2.5%. AUD/USD remained under pressure post-FOMC, starting around 0.6350 then dipping to 0.6325 before edging up slightly. Equity sentiment did not help the Aussie’s cause, though the ASX 200’s -1.8% close was weaker than most of the region.

Currencies/Macro

The US dollar extended its post-Powell press conference rally, up against all G10 currencies on the day. EUR/USD fell from 0.9820 to 0.9750. Sterling was easily weakest in the G10, GBP/USD -2% or -2.3 cents to 1.1155, though most of the fall occurred before the Bank of England decision. USD/JPY is up 35 pips at 148.25, after a range of 147.11 to 148.45. AUD/USD fell about 60 pips or -1% to 0.6290. NZD/USD fell 45 pips to 0.5775. AUD/NZD ground slightly lower to 1.0885 – lowest since May.

The Bank of England hiked by 75bp to 3.0%, as was widely expected, but there were two dissenters in favour of a 50bp and 25bp hike. The statement indicated concerns about the risk of a prolonged recession, and inflation is seen peaking in Q4 2022 at 11% (from 13%). It indicated the policy rate would likely peak below current market pricing. Governor Bailey made this clear in the press conference, saying that if rates reached 5.25% in 2023 as priced in pre-meeting, GDP would contract -3% and inflation fall to zero over the forecast horizon.

The US ISM services index fell to 54.4 in October (est. 55.3, prior 56.7) – a two-year low. Factory orders in September rose 0.3% (est. 0.3%, prior 0.2%). Weekly initial jobless claims were little changed at 217k (est. 220k, prior 218k), with continuing claims rising to 1485k (est. 1450k, prior 1438k).

Interest rates

Bond yields in Europe were higher, with gilts leading the way as the Bank of England delivered a 75bp hike, but was dovish in their rhetoric on being cautious regarding how rate hikes will cause a recession. Yield on the 10yr gilts and 10yr bunds were up around 11bps on the day, while 10yr Italian bond yields was 12bps higher.

US bond yields rose, taking a lead from Europe as well as expectations that the Fed will hike higher for longer. 2yr government bond yields rose from 4.61% to 4.74%, and 10yr government bond yields rose from 4.10% to 4.22% before retracing to 4.12%. The 2-10yr curve has now moved to the most inverse level seen since 1982, at -58bps.

Australian bond yields took trend from global price action, but continues to outperform their US counterparts given the differing stance on rate hikes between the RBA and the Fed. 3yr government bond yields (futures) rose from 3.49% to 3.56% before retracing to 3.48%, 10yr government bond yields (futures) rose from 3.92% to 4.01% before retracing to 3.91%. The AU-US 10yr spread became slightly more inverse on the back of US outperformance, current at -23bps.

Credit moved with broader risk sentiment, extending post Fed (and BOE) weakness with Main out 2.5bp to 113.5 and CDX a further 3bp to 94 with US cash also 2-3bp wider. Primary activity remains subdued with DB the only issuer in the EUR space and going for the low beta option with its EUR1bn 5yr covered deal (MS+8), while the US saw 2 issuers including utility, SoCalEd, which priced USD1.5bn across 5/10yr and NatWest Group which completed a USD1.5bn 4nc3yr at T+285 (BBSW+288) at a NIC of ~15bp.

Commodities

Crude markets were modestly lower as the prospect of further central bank tightening into a global recession weighed on sentiment, despite further tightening in fuel markets. The December WTI contract is last down $1.84 at $88.16 while the January Brent contract is down $1.5 at $94.66. With US east coast diesel inventories at the lowest level on record, the December New York Harbour ULSD contract rose 5% to a fresh 5 month closing high while the European equivalent rose 4.6%.

Meanwhile in gas markets, Bloomberg noted that LNG tankers bound for Europe are beginning to be re-routed to Asia given the warmer weather and close to full storage. One vessel from Qatar made a U-turn in the Mediterranean late October. Natural gas prices in Europe have stabilised in recent sessions, albeit at 5-month lows and down 65% from the August highs.

Metals markets were generally lower with Powell’s “we still have some ways” to go message weighing on sentiment and the US 2/10 curve inverting further. Copper is last down 0.8% at $7,565 while zinc is last down 1.27% at $2,713 and nickel down 5.8% to $22,750. China’s top health official telling local governments to ‘resolutely adhere’ to Covid Zero policies added to the softer trend, though its worthy of note that global copper inventory has plunged 27% in the last two weeks, consistent with recent reports from Bloomberg that more than half of the copper in LME warehouses -- much of which was of Russian origin -- has been ordered out for delivery in the past three weeks bound for Chinese buyers. MMG’s Las Bambas mine in Peru will progressively halt copper production due to road blockades. Alcoa again urged the LME to immediately delist all Russian aluminium brands, “regardless of the production date of the underlying metal”.

Finally note that iron ore didn’t really react to the Covid zero news out of China with the December SGX contract up another $1.40 versus the same time yesterday at $82.25 while the 62% Mysteel index rose 90c to $83.10. Mysteel also reported that more than 20 steel mills in China are shutting down blast furnaces and bringing forward year end maintenance due to poor demand and low margins with capacity cuts ranging from 30 to 60% and about 100kt of daily capacity removed.

Day ahead

At 11:30am Syd, the RBA’s Statement on Monetary Policy will deliver an update on the RBA’s forecasts and provide more detail surrounding their views. Tuesday’s Board statement provided the headline changes of higher inflation and lower GDP growth.

Australia real retail sales are set to slow sharply in Q3 as the spike in retail prices continues to roll through (Westpac f/c: 0.2%).

China: The current account surplus will likely weaken into year-end as cooling global demand weighs on trade.

Eur: The final estimate to October’s S&P Global services PMI is due (market f/c: 48.2).

US: A slowdown in non-farm payrolls is widely anticipated in October (Westpac f/c: 220k, market 195k) though the unemployment rate will likely remain little-changed for now (Westpac and market f/c: 3.6%), allowing for growth in average hourly earnings to remain robust (Westpac and market f/c: 0.3%mth, 4.7%yr). Boston Fed president Susan Collins is also due to speak.

Stay informed with Westpac IQ

Get the latest reports straight to your inbox.

Browse topics

Disclaimer

©2026 Westpac Banking Corporation ABN 33 007 457 141 (including where acting under any of its Westpac, St George, Bank of Melbourne or BankSA brands, collectively, “Westpac”). References to the “Westpac Group” are to Westpac and its subsidiaries and includes the directors, employees and representatives of Westpac and its subsidiaries.

Things you should know

We respect your privacy: You can view the New Zealand Privacy Policy here, or the Australian Group Privacy Statement here. Each time someone visits our site, data is captured so that we can accurately evaluate the quality of our content and make improvements for you. We may at times use technology to capture data about you to help us to better understand you and your needs, including potentially for the purposes of assessing your individual reading habits and interests to allow us to provide suggestions regarding other reading material which may be suitable for you.

This information, unless specifically indicated otherwise, is under copyright of the Westpac Group. None of the material, nor its contents, nor any copy of it, may be altered in any way, transmitted to, copied of distributed to any other party without the prior written permission of the Westpac Group.

Disclaimer

This information has been prepared by Westpac and is intended for information purposes only. It is not intended to reflect any recommendation or financial advice and investment decisions should not be based on it. This information does not constitute an offer, a solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or to enter into a legally binding contract. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision.

This information may contain material provided by third parties. While such material is published with the necessary permission none of Westpac or its related entities accepts any responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure this information is free from error, none of Westpac or its related entities warrants the accuracy, adequacy or completeness of this information, or otherwise endorses it in any way. Except where contrary to law, Westpac Group intend by this notice to exclude liability for this information. This information is subject to change without notice and none of Westpac or its related entities is under any obligation to update this information or correct any inaccuracy which may become apparent at a later date. This information may contain or incorporate by reference forward-looking statements. The words “believe”, “anticipate”, “expect”, “intend”, “plan”, “predict”, “continue”, “assume”, “positioned”, “may”, “will”, “should”, “shall”, “risk” and other similar expressions that are predictions of or indicate future events and future trends identify forward-looking statements. These forward-looking statements include all matters that are not historical facts. Past performance is not a reliable indicator of future performance, nor are forecasts of future performance. Whilst every effort has been taken to ensure that the assumptions on which any forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from any forecasts.

Conflicts of Interest: In the normal course of offering banking products and services to its clients, the Westpac Group may act in several capacities (including issuer, market maker, underwriter, distributor, swap counterparty and calculation agent) simultaneously with respect to a financial instrument, giving rise to potential conflicts of interest which may impact the performance of a financial instrument. The Westpac Group may at any time transact or hold a position (including hedging and trading positions) for its own account or the account of a client in any financial instrument which may impact the performance of that financial instrument.

Author(s) disclaimer and declaration: The author(s) confirms that (a) no part of his/her compensation was, is, or will be, directly or indirectly, related to any views or (if applicable) recommendations expressed in this material; (b) this material accurately reflects his/her personal views about the financial products, companies or issuers (if applicable) and is based on sources reasonably believed to be reliable and accurate; (c) to the best of the author’s knowledge, they are not in receipt of inside information and this material does not contain inside information; and (d) no other part of the Westpac Group has made any attempt to influence this material.

Further important information regarding sustainability-related content: This material may contain statements relating to environmental, social and governance (ESG) topics. These are subject to known and unknown risks, and there are significant uncertainties, limitations, risks and assumptions in the metrics, modelling, data, scenarios, reporting and analysis on which the statements rely. In particular, these areas are rapidly evolving and maturing, and there are variations in approaches and common standards and practice, as well as uncertainty around future related policy and legislation. Some material may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. There is a risk that the analysis, estimates, judgements, assumptions, views, models, scenarios or projections used may turn out to be incorrect. These risks may cause actual outcomes to differ materially from those expressed or implied. The ESG-related statements in this material do not constitute advice, nor are they guarantees or predictions of future performance, and Westpac gives no representation, warranty or assurance (including as to the quality, accuracy or completeness of the statements). You should seek your own independent advice.

Additional country disclosures:

Australia: Westpac holds an Australian Financial Services Licence (No. 233714). You can access Westpac’s Financial Services Guide here or request a copy from your Westpac point of contact. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice.

New Zealand: In New Zealand, Westpac Institutional Bank refers to the brand under which products and services are provided by either Westpac (NZ division) or Westpac New Zealand Limited (company number 1763882), the New Zealand incorporated subsidiary of Westpac ("WNZL"). Any product or service made available by WNZL does not represent an offer from Westpac or any of its subsidiaries (other than WNZL). Neither Westpac nor its other subsidiaries guarantee or otherwise support the performance of WNZL in respect of any such product. WNZL is not an authorised deposit-taking institution for the purposes of Australian prudential standards. The current disclosure statements for the New Zealand branch of Westpac and WNZL can be obtained at the internet address www.westpac.co.nz.

Singapore: This material has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (as defined in the applicable Singapore laws and regulations) only. Recipients of this material in Singapore should contact Westpac Singapore Branch in respect of any matters arising from, or in connection with, this material. Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision by the Monetary Authority of Singapore.

Fiji: Unless otherwise specified, the products and services for Westpac Fiji are available from www.westpac.com.fj © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia and registered as a branch in Fiji. The liability of its members is limited.

Papua New Guinea: Unless otherwise specified, the products and services for Westpac PNG are available from www.westpac.com.pg © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia. Westpac is represented in Papua New Guinea by Westpac Bank - PNG - Limited. The liability of its members is limited.

U.S.: Westpac operates in the United States of America as a federally licensed branch, regulated by the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity Futures Trading Commission (“CFTC”) as a Swap Dealer, but is neither registered as, or affiliated with, a Futures Commission Merchant registered with the US CFTC. The services and products referenced above are not insured by the Federal Deposit Insurance Corporation (“FDIC”). Westpac Capital Markets, LLC (‘WCM’), a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities Exchange Act of 1934 (‘the Exchange Act’) and member of the Financial Industry Regulatory Authority (‘FINRA’). In accordance with APRA's Prudential Standard 222 'Association with Related Entities', Westpac does not stand behind WCM other than as provided for in certain legal agreements between Westpac and WCM and obligations of WCM do not represent liabilities of Westpac.

This communication is provided for distribution to U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors in the United States. WCM is the U.S. distributor of this communication and accepts responsibility for the contents of this communication. Transactions by U.S. customers of any securities referenced herein should be effected through WCM. All disclaimers set out with respect to Westpac apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein, please contact WCM on +1 212 389 1269. Investing in any non-U.S. securities or related financial instruments mentioned in this communication may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related financial instruments may be limited. Non-U.S. companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in effect in the United States. The value of any investment or income from any securities or related derivative instruments denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related derivative instruments.

The author of this communication is employed by Westpac and is not registered or qualified as a research analyst, representative, or associated person of WCM or any other U.S. broker-dealer under the rules of FINRA, any other U.S. self-regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically stated, the views expressed herein are solely those of the author and may differ from the information, views or analysis expressed by Westpac and/or its affiliates.

UK: The London branch of Westpac is authorised in the United Kingdom by the Prudential Regulation Authority (PRA) and is subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA (Financial Services Register number: 124586). The London branch of Westpac is registered at Companies House as a branch established in the United Kingdom (Branch No. BR000106). Details about the extent of the regulation of Westpac’s London branch by the PRA are available from us on request.

This communication is not being made to or distributed to, and must not be passed on to, the general public in the United Kingdom. Rather, this communication is being made only to and is directed at (a) those persons falling within the definition of Investment Professionals (set out in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”)); (b) those persons falling within the definition of high net worth companies, unincorporated associations etc. (set out in Article 49(2)of the Order; (c) other persons to whom it may lawfully be communicated in accordance with the Order or (d) any persons to whom it may otherwise lawfully be made (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. In the same way, the information contained in this communication is intended for “eligible counterparties” and “professional clients” as defined by the rules of the Financial Conduct Authority and is not intended for “retail clients”. Westpac expressly prohibits you from passing on the information in this communication to any third party.

European Economic Area (“EEA”): This material may be distributed to you by either: (i) Westpac directly, or (ii) Westpac Europe GmbH (“WEG”) under a sub-licensing arrangement. WEG has not edited or otherwise modified the content of this material. WEG is authorised in Germany by the Federal Financial Supervision Authority (‘BaFin’) and subject to its regulation. WEG’s supervisory authorities are BaFin and the German Federal Bank (‘Deutsche Bundesbank’). WEG is registered with the commercial register (‘Handelsregister’) of the local court of Frankfurt am Main under registration number HRB 118483. In accordance with APRA’s Prudential Standard 222 ‘Association with Related Entities’, Westpac does not stand behind WEG other than as provided for in certain legal agreements (a risk transfer, sub-participation and collateral agreement) between Westpac and WEG and obligations of WEG do not represent liabilities of Westpac. Any product or service made available by WEG does not represent an offer from Westpac or any of its subsidiaries (other than WEG). All disclaimers set out with respect to Westpac apply equally to WEG.

This communication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This communication contains general commentary, research, and market colour. The communication does not constitute investment advice. The material may contain an ‘investment recommendation’ and/or ‘information recommending or suggesting an investment’, both as defined in Regulation (EU) No 596/2014 (including as applicable in the United Kingdom) (“MAR”). In accordance with the relevant provisions of MAR, reasonable care has been taken to ensure that the material has been objectively presented and that interests or conflicts of interest of the sender concerning the financial instruments to which that information relates have been disclosed.

Investment recommendations must be read alongside the specific disclosure which accompanies them and the general disclosure which can be found here. Such disclosure fulfils certain additional information requirements of MAR and associated delegated legislation and by accepting this communication you acknowledge that you are aware of the existence of such additional disclosure and its contents.

To the extent this communication comprises an investment recommendation it is classified as non-independent research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and therefore constitutes a marketing communication. Further, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research.