Markets Daily

The US dollar was soft for most of the overnight session, but rebounded in late dealings as risk appetite and stocks took a hit on rising Mideast tensions. Bond yields were mixed, ahead of important US payrolls data. Fedspeak emphasised patience, and jobless claims data was slightly cooler.

Currencies/Macro

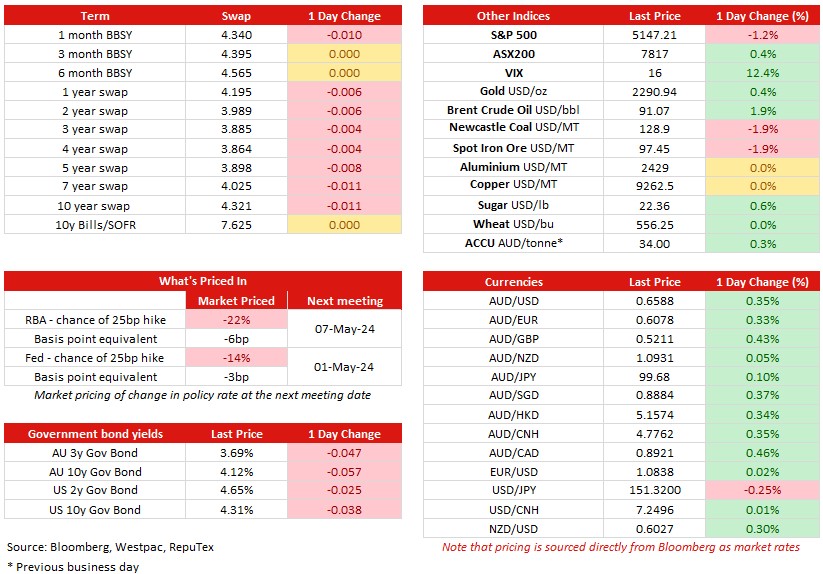

The US dollar index was down 0.3% at one stage overnight, extending the softer momentum that developed after the previous’ day’s weaker than expected services March ISM. But the US dollar index clawed back to be largely unchanged in late offshore dealings, as risk appetite took a knock on surging energy prices amid rising mid-east tensions. The S&P500 fell 1.2%. EUR rose from 1.0840 to 1.0877 but finished back where it started at 1.0837. USD/JPY ranged sideways between 151.51 and 151.77 for most of the session, but slipped to 151.35 in late trade.

The AUD rose from 0.6580 to 0.6619 offshore and starts the day lower at 0.6586 after risk appetite took a hit in late trading offshore. NZD rose from 0.6020 to 0.6047. AUD/NZD rose from 1.0913 to 1.0956 – a fresh five-month high.

US weekly initial jobless claims rose slightly to 221k (est. 214k, prior 212k), with continuing claims at 1791k (est. 1811k, prior 1810k).

FOMC member Harker (non-voter) said inflation was still too high: “We’re not where we need to be. Inflation is still too high, particularly for the ALICE communities — the asset-limited communities, and income constrained.” Barkin (voter) said: “No one wants inflation to reemerge. Given a strong labour market, we have time for the clouds to clear before beginning the process of toggling rates down. I am optimistic that keeping rates somewhat restrictive can bring inflation back to our target”. Goolsbee said of the recent inflation data bump: “My overall assessment is that these two months should not knock us off the path back to target”. Mester (voter) wanted to see two more months of data to assess inflation. Kashkari (non-voter) pondered a no-cut scenario: “In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target. If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.”

Interest rates

The US 2yr treasury yield fluctuated between 4.64% and 4.70%, currently 4.66%, while the 10yr yield traded between 4.31% and 4.38%, currently 4.31%. Markets price the Fed funds rate, currently 5.375% (mid), to be unchanged at the next meeting on 2 May, with a 60% chance of a cut by June.

Australian government bond yields (futures) ranged between 3.67% and 3.72%, while the 10yr yield ranged between 4.14% and 4.19%. Markets currently price the RBA cash rate to be unchanged at the next meeting on 7 May, with a 75% chance of a cut by September.

New Zealand rates markets price the OCR, currently at 5.50%, to be unchanged at the next meeting on 10 April, with a 100% chance of cut by August.

Credit indices reflected the shift in broader risk markets with Main 1.5bp tighter to 53.5, while CDX has given up early gains of a similar amount to now be 2bp higher at 54 (above Main) with US IG cash also moving late in the session to be 1-2bp wider. Primary activity was solid in Europe with 7 issuers pricing EUR4.9bn with corporate issuers heavy in the mix (EUR3.4bn) while in the bank space we saw BMO print a EUR1bn 3yr FRN at E+47 (BBSW+73), however the US was quieter.

Commodities

Brent crude pushed above $90 as traders focussed on risks that Middle East tensions would add to supply pressures. The May WTI contract is up 1.5% to $86.72 while the June Brent contract is up 1.75% to $90.91. News that the Israeli army had cancelled all leave and warnings from the Israeli PM that the country would harm “whoever harms or plans to harm us” added to the momentum in prices. Bloomberg noted that Brent’s rally above $90 brought 32,000 lots of June expiry call options between $90 and $91 sending implied volatility to the highest in over a month. JP Morgan noted that recent Ukrainian drone strikes threatened to take a significant amount of Russia’s oil refining capacity offline as the attacks extended much further into the country. About 670kbpd of capacity is offline following the drone attack on the 340kbpd Taneco refinery this week, which is 1,200km away from Ukrainian lines. That radius includes 19 refineries with a combined capacity of 3.8mb or more than half of Russia’s capacity!

Metals continued their breakout move with copper up another 1.26% at $9,379 while aluminium rose 0.66% to $2,445. Copper is up 5.8% over the last week and aluminium is up 6.1%. Adding to the pressure on copper, Codelco signalled that output in 2024 was still running well below 2023 levels with 326kt of copper produced in Q1 down from 352kt in the same period a year ago. The chairman stated that “we are recovering, and we will continue to do so” with annual production guidance of between 1.33mt and 1.39mt, a slight increase from last year’s level. Chilean port workers also staged protests on Thursday, disrupting the loading and unloading of ships at the Ventanas port. Countering signs of demand in the futures market, the spread between spot and the 3m LME copper contract fell to a fresh 3 decade low at -$116.50 suggesting that physical demand was low. At the same time, global copper inventories are all but hitting the highest level in 4 years.

Finally note that iron ore markets hit 10-month lows as rising exports and faltering Chinese demand signals weighed on prices. The May SGX contract is down 5c from the same time yesterday at $97.75 while the 62% Mysteel index fell another $1.90 to $97.45. Spot steel prices continued their steady march lower with rebar used in construction hitting lows back to August last year, down 8% in the last two months. China will publish its first batch of March trade data including iron ore imports on Friday next week.

Day ahead

Australia: The goods trade surplus likely narrowed in February, given the drag on export earnings from lower commodity prices over the month (Westpac f/c: $9.7bn; market f/c: $10.5bn).

Japan: February’s household spending will continue to paint a weak picture for consumption, likely confirming a full year of declines (market f/c: –2.9%yr).

Eurozone: Declines in retail sales are set to persist as intense financial pressures continue to loom over households (market f/c: –0.4%).

US: Growth in nonfarm payrolls is widely expected to moderate in February, moving more in line with most other indicators reflecting a softening labour market (Westpac f/c: 180k; market f/c: 215k). With robust participation, the unemployment rate may hold flat at its current rate (Westpac f/c: 3.9%; market f/c: 3.8%); but, as it continues to grind higher over the year, growth in average hourly earnings will soften (market f/c: 0.3%). The FOMC’s Barkin, Logan and Bowman are also due to speak.

China: National holiday for the Qing Ming Jie festival.

Stay informed with Westpac IQ

Get the latest reports straight to your inbox.

Browse topics

Disclaimer

©2026 Westpac Banking Corporation ABN 33 007 457 141 (including where acting under any of its Westpac, St George, Bank of Melbourne or BankSA brands, collectively, “Westpac”). References to the “Westpac Group” are to Westpac and its subsidiaries and includes the directors, employees and representatives of Westpac and its subsidiaries.

Things you should know

We respect your privacy: You can view the New Zealand Privacy Policy here, or the Australian Group Privacy Statement here. Each time someone visits our site, data is captured so that we can accurately evaluate the quality of our content and make improvements for you. We may at times use technology to capture data about you to help us to better understand you and your needs, including potentially for the purposes of assessing your individual reading habits and interests to allow us to provide suggestions regarding other reading material which may be suitable for you.

This information, unless specifically indicated otherwise, is under copyright of the Westpac Group. None of the material, nor its contents, nor any copy of it, may be altered in any way, transmitted to, copied of distributed to any other party without the prior written permission of the Westpac Group.

Disclaimer

This information has been prepared by Westpac and is intended for information purposes only. It is not intended to reflect any recommendation or financial advice and investment decisions should not be based on it. This information does not constitute an offer, a solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or to enter into a legally binding contract. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision.

This information may contain material provided by third parties. While such material is published with the necessary permission none of Westpac or its related entities accepts any responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure this information is free from error, none of Westpac or its related entities warrants the accuracy, adequacy or completeness of this information, or otherwise endorses it in any way. Except where contrary to law, Westpac Group intend by this notice to exclude liability for this information. This information is subject to change without notice and none of Westpac or its related entities is under any obligation to update this information or correct any inaccuracy which may become apparent at a later date. This information may contain or incorporate by reference forward-looking statements. The words “believe”, “anticipate”, “expect”, “intend”, “plan”, “predict”, “continue”, “assume”, “positioned”, “may”, “will”, “should”, “shall”, “risk” and other similar expressions that are predictions of or indicate future events and future trends identify forward-looking statements. These forward-looking statements include all matters that are not historical facts. Past performance is not a reliable indicator of future performance, nor are forecasts of future performance. Whilst every effort has been taken to ensure that the assumptions on which any forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from any forecasts.

Conflicts of Interest: In the normal course of offering banking products and services to its clients, the Westpac Group may act in several capacities (including issuer, market maker, underwriter, distributor, swap counterparty and calculation agent) simultaneously with respect to a financial instrument, giving rise to potential conflicts of interest which may impact the performance of a financial instrument. The Westpac Group may at any time transact or hold a position (including hedging and trading positions) for its own account or the account of a client in any financial instrument which may impact the performance of that financial instrument.

Author(s) disclaimer and declaration: The author(s) confirms that (a) no part of his/her compensation was, is, or will be, directly or indirectly, related to any views or (if applicable) recommendations expressed in this material; (b) this material accurately reflects his/her personal views about the financial products, companies or issuers (if applicable) and is based on sources reasonably believed to be reliable and accurate; (c) to the best of the author’s knowledge, they are not in receipt of inside information and this material does not contain inside information; and (d) no other part of the Westpac Group has made any attempt to influence this material.

Further important information regarding sustainability-related content: This material may contain statements relating to environmental, social and governance (ESG) topics. These are subject to known and unknown risks, and there are significant uncertainties, limitations, risks and assumptions in the metrics, modelling, data, scenarios, reporting and analysis on which the statements rely. In particular, these areas are rapidly evolving and maturing, and there are variations in approaches and common standards and practice, as well as uncertainty around future related policy and legislation. Some material may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. There is a risk that the analysis, estimates, judgements, assumptions, views, models, scenarios or projections used may turn out to be incorrect. These risks may cause actual outcomes to differ materially from those expressed or implied. The ESG-related statements in this material do not constitute advice, nor are they guarantees or predictions of future performance, and Westpac gives no representation, warranty or assurance (including as to the quality, accuracy or completeness of the statements). You should seek your own independent advice.

Additional country disclosures:

Australia: Westpac holds an Australian Financial Services Licence (No. 233714). You can access Westpac’s Financial Services Guide here or request a copy from your Westpac point of contact. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice.

New Zealand: In New Zealand, Westpac Institutional Bank refers to the brand under which products and services are provided by either Westpac (NZ division) or Westpac New Zealand Limited (company number 1763882), the New Zealand incorporated subsidiary of Westpac ("WNZL"). Any product or service made available by WNZL does not represent an offer from Westpac or any of its subsidiaries (other than WNZL). Neither Westpac nor its other subsidiaries guarantee or otherwise support the performance of WNZL in respect of any such product. WNZL is not an authorised deposit-taking institution for the purposes of Australian prudential standards. The current disclosure statements for the New Zealand branch of Westpac and WNZL can be obtained at the internet address www.westpac.co.nz.

Singapore: This material has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (as defined in the applicable Singapore laws and regulations) only. Recipients of this material in Singapore should contact Westpac Singapore Branch in respect of any matters arising from, or in connection with, this material. Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision by the Monetary Authority of Singapore.

Fiji: Unless otherwise specified, the products and services for Westpac Fiji are available from www.westpac.com.fj © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia and registered as a branch in Fiji. The liability of its members is limited.

Papua New Guinea: Unless otherwise specified, the products and services for Westpac PNG are available from www.westpac.com.pg © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia. Westpac is represented in Papua New Guinea by Westpac Bank - PNG - Limited. The liability of its members is limited.

U.S.: Westpac operates in the United States of America as a federally licensed branch, regulated by the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity Futures Trading Commission (“CFTC”) as a Swap Dealer, but is neither registered as, or affiliated with, a Futures Commission Merchant registered with the US CFTC. The services and products referenced above are not insured by the Federal Deposit Insurance Corporation (“FDIC”). Westpac Capital Markets, LLC (‘WCM’), a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities Exchange Act of 1934 (‘the Exchange Act’) and member of the Financial Industry Regulatory Authority (‘FINRA’). In accordance with APRA's Prudential Standard 222 'Association with Related Entities', Westpac does not stand behind WCM other than as provided for in certain legal agreements between Westpac and WCM and obligations of WCM do not represent liabilities of Westpac.

This communication is provided for distribution to U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors in the United States. WCM is the U.S. distributor of this communication and accepts responsibility for the contents of this communication. Transactions by U.S. customers of any securities referenced herein should be effected through WCM. All disclaimers set out with respect to Westpac apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein, please contact WCM on +1 212 389 1269. Investing in any non-U.S. securities or related financial instruments mentioned in this communication may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related financial instruments may be limited. Non-U.S. companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in effect in the United States. The value of any investment or income from any securities or related derivative instruments denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related derivative instruments.

The author of this communication is employed by Westpac and is not registered or qualified as a research analyst, representative, or associated person of WCM or any other U.S. broker-dealer under the rules of FINRA, any other U.S. self-regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically stated, the views expressed herein are solely those of the author and may differ from the information, views or analysis expressed by Westpac and/or its affiliates.

UK: The London branch of Westpac is authorised in the United Kingdom by the Prudential Regulation Authority (PRA) and is subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA (Financial Services Register number: 124586). The London branch of Westpac is registered at Companies House as a branch established in the United Kingdom (Branch No. BR000106). Details about the extent of the regulation of Westpac’s London branch by the PRA are available from us on request.

This communication is not being made to or distributed to, and must not be passed on to, the general public in the United Kingdom. Rather, this communication is being made only to and is directed at (a) those persons falling within the definition of Investment Professionals (set out in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”)); (b) those persons falling within the definition of high net worth companies, unincorporated associations etc. (set out in Article 49(2)of the Order; (c) other persons to whom it may lawfully be communicated in accordance with the Order or (d) any persons to whom it may otherwise lawfully be made (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. In the same way, the information contained in this communication is intended for “eligible counterparties” and “professional clients” as defined by the rules of the Financial Conduct Authority and is not intended for “retail clients”. Westpac expressly prohibits you from passing on the information in this communication to any third party.

European Economic Area (“EEA”): This material may be distributed to you by either: (i) Westpac directly, or (ii) Westpac Europe GmbH (“WEG”) under a sub-licensing arrangement. WEG has not edited or otherwise modified the content of this material. WEG is authorised in Germany by the Federal Financial Supervision Authority (‘BaFin’) and subject to its regulation. WEG’s supervisory authorities are BaFin and the German Federal Bank (‘Deutsche Bundesbank’). WEG is registered with the commercial register (‘Handelsregister’) of the local court of Frankfurt am Main under registration number HRB 118483. In accordance with APRA’s Prudential Standard 222 ‘Association with Related Entities’, Westpac does not stand behind WEG other than as provided for in certain legal agreements (a risk transfer, sub-participation and collateral agreement) between Westpac and WEG and obligations of WEG do not represent liabilities of Westpac. Any product or service made available by WEG does not represent an offer from Westpac or any of its subsidiaries (other than WEG). All disclaimers set out with respect to Westpac apply equally to WEG.

This communication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This communication contains general commentary, research, and market colour. The communication does not constitute investment advice. The material may contain an ‘investment recommendation’ and/or ‘information recommending or suggesting an investment’, both as defined in Regulation (EU) No 596/2014 (including as applicable in the United Kingdom) (“MAR”). In accordance with the relevant provisions of MAR, reasonable care has been taken to ensure that the material has been objectively presented and that interests or conflicts of interest of the sender concerning the financial instruments to which that information relates have been disclosed.

Investment recommendations must be read alongside the specific disclosure which accompanies them and the general disclosure which can be found here. Such disclosure fulfils certain additional information requirements of MAR and associated delegated legislation and by accepting this communication you acknowledge that you are aware of the existence of such additional disclosure and its contents.

To the extent this communication comprises an investment recommendation it is classified as non-independent research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and therefore constitutes a marketing communication. Further, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research.