Q4 2023 Sustainable Finance Market Update

Welcome to Westpac IQ’s quarterly sustainable finance market update.

Westpac publications and media

- Westpac topped the 2023 Australian Sustainable Bond League Table (for the period 1 January – 1 November 2023), with 7 deals and a total volume of A$1,950m and 22.8% of the market share.

- Westpac supported Australian Unity in launching an A$50m Sustainability-Linked Loan, connected to well-being, community and social value. The transaction won Environmental Finance’s Impact Initiative of the Year – Oceania 2023.

- Environmental Finance - Westpac and Macquarie back Australian Government's social Impact Investment Initiative December 2023.

Westpac Wire

- The first commercially funded wind farm financed by Westpac turns 20 and sets the scene for Australia’s renewables century December 2023.

- WBB to support farmers in net zero transition November 2023.

- The next climate frontier – becoming “nature positive” – is likely to be much quicker to land, according to Westpac’s chief sustainability officer Siobhan Toohill November 2023.

Outlook for the year ahead

2024 will be a pivotal year for our collective response to climate change, including:

- Moody’s released its sustainable bond forecast for 2024, expecting issuance to remain flat with growth in green and sustainability bonds expected to be offset by weaknesses in social and sustainability-linked bonds.

- Accelerating renewables development – 130 national governments agreed to collectively triple the world’s installed renewable energy capacity by 2030 at COP28. The IEA predicts more renewable capacity will be added in the next five years than has been installed in the last 100 years.

- Increasing sustainability disclosures and transition planning – Deloitte expects corporates will prioritise sustainability reporting requirements such as standards based on the ISSB and transition planning guidance. The Australian Government’s focus on implementing mandatory climate disclosures will hasten this process, with proposals for some of Australia’s largest emitters and financial institutions to begin disclosing ISSB-aligned standards as early as 1 July 2024.

- Increasing capital flows to climate change adaptation, nature-based solutions and promoting biodiversity.

- Interim targets check in – 2024 will be the last year before many institutions report against interim 2025 greenhouse gas emissions reduction targets. Tracking target performance helps to inform the market of the likelihood of meeting longer term 2030 and 2050 emissions reduction and net zero targets.

Sustainable debt market update

Australian and New Zealand Sustainable Finance volumes totalled US$34.44bn in 2023, down 21% from 2022, although in line with the global trend. The drop was partially offset by record issuance of Green Bonds, which contributed US$12.07bn, or 35%, of the total issuance, surpassing its previous high of US$10.78bn. The slide in issuances may have been caused by borrowers reviewing the robustness of their ESG commitments and processes amid a heightened focus on greenwashing. Moody’s outlook for 2024, however, expects Asia-Pacific issuance to continue “grow[ing] steadily” as focus grows on transition finance in the region.

Key transactions for the Australia – New Zealand market

Housing Australia (Sustainability Bond), Humm Group (Climate Bond), Manawa Energy (Green Bonds Reclassification), Mansons (Green Loan), Downer (Sustainability-Linked Loan).

Sustainable debt market update

Global observations

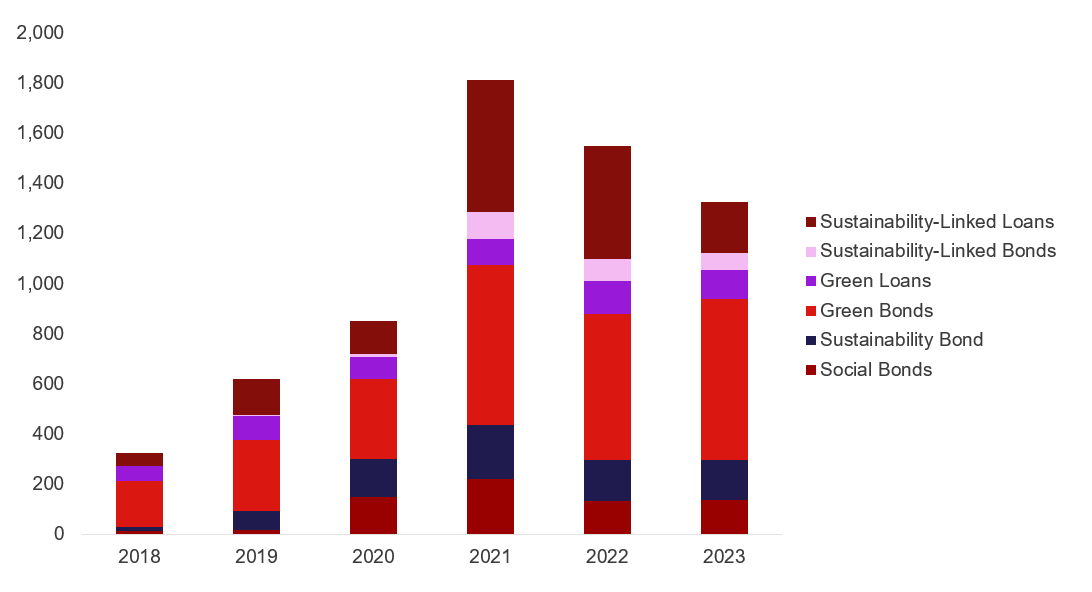

Global Issuance (US$ bn)

Source for graphs and observations: BloombergNEF as at 31 December 2023. Noting data excludes Social and Sustainability Loans and Sustainable Financing Bonds.

Global Sustainable Debt Issuance totalled US$1,326bn during 2023, down 15% from 2022. The Sustainable Bond market continued to grow in 2023, with a record year of Green Bond issuance. Sustainable Bonds have accounted for a steadily growing share of overall global issuance, peaking at 14% in both 2022 and 2023.

Sustainable Bond issuance grew 4% in 2023 from 2022, driven heavily by an increase of Green Bonds, which saw a record year with over US$643bn issued, accounting for 64% of Sustainable Bonds issued in 2023. While the Social Bond market experienced modest growth in 2023 (0.7% increase from 2022), both Sustainability Bonds and Sustainability-Linked Bond issuance decreased from 2021 and 2022 issuance volumes. The relative strength of the Green Bond market may be attributed to the robust taxonomies Green Bonds are progressively issued against in a time of increased scrutiny around greenwashing globally.

Sustainable Loan issuance globally declined by 45% in 2023 from 2022, driven by a decrease in Sustainability-Linked Loans of 55% during this timeframe. This overall decline in sustainable loan issuance may have been due in part to a heightened focus on greenwashing. The risks of greenwashing have led to borrowers increasingly reviewing the robustness of ESG data, commitments and processes before linking ESG commitments into their financing.

Australia-New Zealand observations

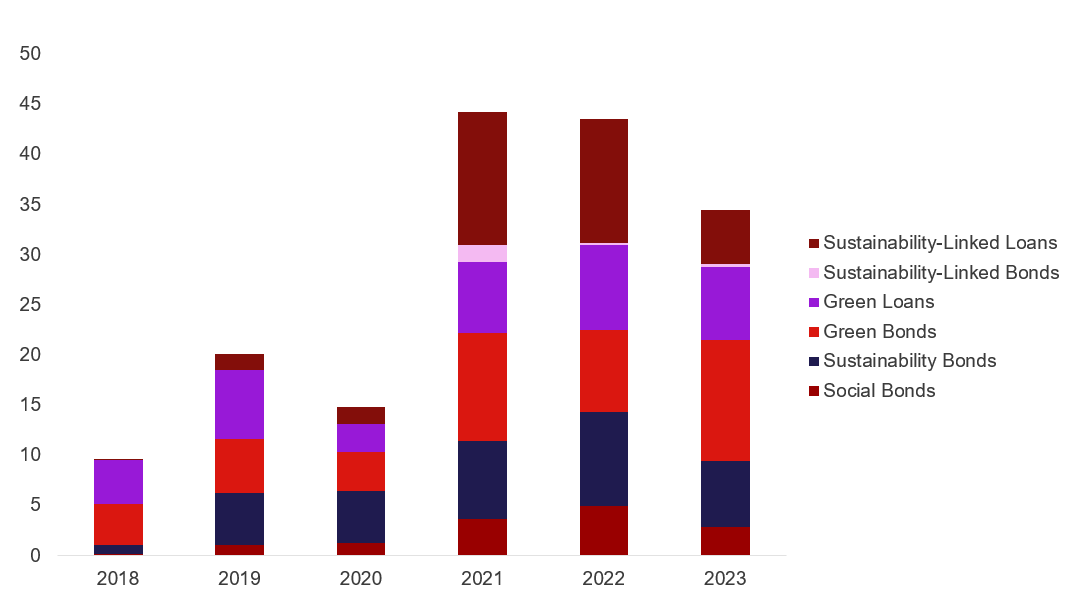

Australia-New Zealand Issuance (US$ bn)

Source for graphs and observations: BloombergNEF as at 30 September 2023. Noting data excludes Social and Sustainability Loans. Australia & New Zealand volumes based off issuer currency (AUD and NZD).

Australia-New Zealand Sustainable Debt Issuance totalled US$34.44bn during 2023, down 21% from 2022, in line with the global trend. The year saw a strong issuance of Sustainable Bonds, with volumes materially consistent with 2021 and 2022 volumes.

Mirroring the global market, Sustainable Bonds have dominated Sustainable Debt issuance in Australia-New Zealand this year, with Green Bonds contributing US$12.07bn (or 35% of total Sustainable Debt issued), making for a record year and surpassing the previous high of US$10.78bn. Sustainability-Linked Bonds also saw increases of 74% from 2022, however, remain a minor contributor to total Australia-New Zealand Sustainable Bond volume at 1.4%. Social Bonds and Sustainability Bonds reduced by 43% and 30% respectively from 2022, with issuers focusing on green assets/ activities.

Overall Sustainable Loan volumes in Australia-New Zealand reduced by 40% from 2022. Sustainability-Linked Loans experienced the greatest drop in volume sliding 57% from 2022. This overall decline in Sustainable Loan issuance may have been exacerbated by an overall reduction in syndicated loans volume, as illustrated by a 5% fall in the APAC (ex-Japan) region, as well as greater caution by borrowers around greenwashing. ASIC launched its first court action against a greenwashing conduct earlier this year. However, Bloomberg expects to see a pick-up in volume in Sustainability-Linked Loans issuance in 2024 as roughly US$27bn in the APAC (ex-Japan) region are set to be due and may seek refinancing.

Notable use of proceeds and sustainability-linked issuances

Use of proceeds issuances

Humm ABS Trust 2023-1 (Climate Bond) – Westpac supported Humm Group in its latest A$301m ABS transaction which contained a mix of climate certified bonds (proceeds used to fund solar energy related assets) and non-climate certified bonds. The transaction evidences Humm’s continued leadership in the Australian green ABS market over the past 8 years, having now completed 9 climate bond certified ABS transactions and issued over A$750m of green asset-backed securities.

Westpac acted as Arranger, JLM and Sustainability Coordinator on this trade.

Manawa Energy (Green Bonds Reclassification) – Westpac NZ supported Manawa Energy to establish its Sustainable Finance Framework and Eligible Assets Register which identifies eligible hydroelectricity assets (NZ$ ~1.7bn) that were verified as aligning to the Green Bond Principles. This enabled Manawa Energy to recognise its three NZX-listed bonds (NZ$375m) as Green Bonds and support future issuances of Green Bonds.

Westpac NZ acted as Sole Sustainability Coordinator Press Release.

Mansons (Green Loan) – Executed a Green Loan to finance the development of a new 6-Star Green Star (Design & Built) rated commercial property in Auckland.

Westpac NZ acted as Sole Sustainability Coordinator.

Housing Australia (Sustainability Bond) – Westpac supported Housing Australia with the pricing of a new A$422m November -2038 Sustainability Bond transaction that supports the delivery of 1,370 new homes in Melbourne across four housing projects. The transaction evidences expanding appetite for Housing Australia’s sustainability priorities, particularly social and affordable housing.

Westpac acted as JLM and hedge manager on this trade. KangaNews.

Sustainability-Linked Issuances

Downer (Sustainability-Linked Loan) – Successfully completed refinancing of A$500m of a A$1,400m syndicated Sustainability-Linked Loan facility. Downer established a new sustainability-linked financing framework, which would strengthen its sustainability credentials across the Group.

Westpac was Mandated Lead Arranger and Bookrunner. ASX Release

Regulatory, standards and policy developments

Australia - New Zealand

Australia released its Sustainable Finance Strategy, aiming to amend existing laws/regulations to reduce barriers to Sustainable Finance

The Australian Government released its Sustainable Finance Strategy Consultation Paper. The Strategy proposes a range of measures to reduce barriers to sustainable investments, including: a new sustainable finance taxonomy, new labelling laws for marketing investment products, globally-consistent climate disclosures and the issuance of sovereign green bonds from 2024. The Government has indicated an intention to incorporate nature and biodiversity objectives into the Strategy.

New Zealand Commerce Commission publishes Collaboration and Sustainability Guidelines

The Collaboration and Sustainability Guidelines were published in recognition that collaboration with competitors may be necessary to overcome the challenges that individual businesses face to meet New Zealand’s climate change commitments and sustainability goals. The Guidelines explain when collaboration for sustainability objectives is more or less likely to harm competition and explain how, through the clearance and authorisation processes, New Zealand’s competition laws can accommodate collaboration between businesses even when it may harm competition. These Guidelines have the potential to address a key roadblock to sustainability initiatives, with a recent Linklaters survey finding that 60% of sustainability professions were put off on collaborating on ESG issues due to fear of breaking competition laws.

Australia announces the Commonwealth Capacity Investment Scheme

The Australian Government announced the expansion of the Capacity Investment Scheme (CIS) which involves the underwriting of 32GW of renewable energy and ‘clean dispatchable capacity’ nationally by 2030, to support Australia to achieve its 82% renewable energy target by 2030. This will accelerate development from the National Electricity Market’s total current generation capacity which is currently approximately 65GW. The Scheme invites bids for project-specific competitive tenders held bi-annually and provides successful proponents a contract for difference agreement that would assure revenue within a set price range.

Tightening of Fuel Standards in Australia

In a bid to improve public health and save fuel costs, the Australian Government announced new fuel quality and noxious emission standards commencing December 2025. The tightening of petrol standards to ‘Euro 6d’ brings Australia in line with 80% of the global car market, including the US, the EU, China, Japan and Korea. The emission standards are expected to save A$6.1m in health and fuel costs by 2040.

International

The EU’s Carbon Border Adjustment Mechanism (CBAM) comes into effect

From 1 October 2023, EU importers were required to begin reporting its greenhouse gas emissions embedded during the production of goods covered by the CBAM as the world’s first carbon border tariff came into force. These goods include iron and steel, cement, fertilisers, aluminium, electricity and hydrogen. The EU will start collecting carbon levies from 2026, when importers will be required to purchase certificates to cover excess C02 emissions above EU producers. The Scheme is intended to counter the risk of carbon leakage and to encourage a worldwide shift to greener production.

Belgium court orders government to cut emissions faster

Nonprofit group Klimaatzaak, on behalf of 58,000 claimants, successfully sued the Belgian Federal Government for negligent climate policy, with Brussels Court of Appeal ordering the Federal Government to accelerate its emissions cuts to at least 55% from 1990 levels by 2030. The Court rejected arguments that Belgium’s impact on the climate crisis was limited by its small size and found that its climate governance to date had violated human rights.

Sustainable finance news

Australia-New Zealand

Australian Renewable Energy Agency (ARENA) launches its Hydrogen Headstart Program

The Australian Government kickstarted a A$2bn program which aims to catalyse Australia’s green hydrogen industry. The programme, designed by ARENA and the Department of Climate Change, Energy, the Environment and Water, was announced in the 2023-24 Budget. Successful applicants receive a production credit delivered over ten years to bridge the cost between producing green hydrogen and the market price.

Australian Agriculture and Land public consultation on Net Zero 2050 Plan

The Australian Government, through the Department of Climate Change, Energy, the Environment and Water, and the Department of Agriculture, Fisheries and Forestry have extended an invitation to provide feedback on how the agriculture and land sectors can play a part in the economy-wide Net Zero 2050 Plan. This is the first public consultation on the 6 sectoral plans to reduce emissions that the Government is working on, including Agriculture and Land, Electricity and Energy, Industry, Resources, the Built Environment and Transport.

Toitū Envirocare transitions away from allowing NZ Carbon Credits

Toitū Envirocare has announced a move to transition away from accepting New Zealand carbon credits in its carbon certification programmes. The company states that the shift aligns with the evolving standards in the global voluntary carbon market and that New Zealand carbon credits no longer meet the latest international best practice. The transition is expected to commence in early 2024, once the new best practice becomes operational.

Green Building Council of Australia publishes a Sustainable Finance guide for the Australian Real Estate sector

The Sustainable Finance guide explains the various sustainable finance instruments currently being used, with the aim of improving the sector’s understanding, and uptake, of sustainable finance. It also reviews current green building certifications, benchmarks and rating tools and how they can be used to assess the green credentials of projects.

International

COP28 Roundup

COP28 concluded in Dubai, with several notable positive outcomes. The operationalisation of a global Loss and Damage Fund was agreed to provide financial assistance to developing countries to cope with climate change. Commitments totalled more than US$792m, although Australia has not indicated it would make a direct contribution to this fund. Methane was also a critical focus, with an Oil and Gas Decarbonization Charter committing members’ oil and gas operations to near-zero methane by 2030. Participants also agreed to “tripling renewable energy capacity globally and doubling global average annual rate of energy efficiency improvements by 2030”, in-line with the recent IEA 2023 Net Zero Roadmap, as well as the final decision text which called for “accelerating efforts towards the phase-down of unabated coal power”.

Climate Bonds Initiative releases a new guide on issuing bonds to fund the climate transition

A new guide, developed by the European Bank for Reconstruction and Development and the Climate Bonds Initiative provides issuers with a step-by-step guidance for using a credible Green, Social and Sustainability Bond to finance a corporate climate transition plan. The guide follows the Climate Bonds Hallmarks for a credible transition and the ICMA guidance on climate transition finance.

World Economic Forum issued the 2024 Global Risk Report

The Global Risks Report 2024 from the World Economic Forum explores some of the most severe risks we may face over the next decade. The report warns that as cooperation comes under pressure, weakened economies and societies may only require the smallest shock to edge past the tipping point of resilience. Extreme weather events are ranked as the most severe global risk for the next decade, followed by critical change the earths systems, biodiversity loss and ecosystem collapse.

European Securities and Markets Authority (ESMA) releases analysis on European ESG bonds and pricing advantages

ESMA published an article discussing the existence of “Greenium” across different types of sustainable-labelled debt instruments. In the article, ESMA indicates that it cannot confirm systemic pricing benefits for ESG-labelled debt types, although the research did reveal “price divergences between sustainable and conventional debt instruments seem to stem from the same fundamental risk factors, for example an issuer’s credit worthiness, and are not purely driven by a bond’s ESG status”.

France’s EDF sells Europe’s first green bonds for nuclear energy

French utility Electricite de France raised a €1bn in green bonds to finance nuclear energy projects. Net proceeds from the bond will be used for expenditures associated with lifetime extensions for existing French nuclear reactors and would represent the first green bond aligned with the EU taxonomy whose proceeds would go towards nuclear energy projects.

Contact our sustainable finance team

Australia: Eliza Mathews - Head of Sustainable Finance, Australia

New Zealand: Joanna Silver - Head of Sustainable Finance, New Zealand

Stay informed with Westpac IQ

Get the latest reports straight to your inbox.

Browse topics

Disclaimer

©2026 Westpac Banking Corporation ABN 33 007 457 141 (including where acting under any of its Westpac, St George, Bank of Melbourne or BankSA brands, collectively, “Westpac”). References to the “Westpac Group” are to Westpac and its subsidiaries and includes the directors, employees and representatives of Westpac and its subsidiaries.

Things you should know

We respect your privacy: You can view the New Zealand Privacy Policy here, or the Australian Group Privacy Statement here. Each time someone visits our site, data is captured so that we can accurately evaluate the quality of our content and make improvements for you. We may at times use technology to capture data about you to help us to better understand you and your needs, including potentially for the purposes of assessing your individual reading habits and interests to allow us to provide suggestions regarding other reading material which may be suitable for you.

This information, unless specifically indicated otherwise, is under copyright of the Westpac Group. None of the material, nor its contents, nor any copy of it, may be altered in any way, transmitted to, copied of distributed to any other party without the prior written permission of the Westpac Group.

Disclaimer

This information has been prepared by Westpac and is intended for information purposes only. It is not intended to reflect any recommendation or financial advice and investment decisions should not be based on it. This information does not constitute an offer, a solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or to enter into a legally binding contract. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision.

This information may contain material provided by third parties. While such material is published with the necessary permission none of Westpac or its related entities accepts any responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure this information is free from error, none of Westpac or its related entities warrants the accuracy, adequacy or completeness of this information, or otherwise endorses it in any way. Except where contrary to law, Westpac Group intend by this notice to exclude liability for this information. This information is subject to change without notice and none of Westpac or its related entities is under any obligation to update this information or correct any inaccuracy which may become apparent at a later date. This information may contain or incorporate by reference forward-looking statements. The words “believe”, “anticipate”, “expect”, “intend”, “plan”, “predict”, “continue”, “assume”, “positioned”, “may”, “will”, “should”, “shall”, “risk” and other similar expressions that are predictions of or indicate future events and future trends identify forward-looking statements. These forward-looking statements include all matters that are not historical facts. Past performance is not a reliable indicator of future performance, nor are forecasts of future performance. Whilst every effort has been taken to ensure that the assumptions on which any forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from any forecasts.

Conflicts of Interest: In the normal course of offering banking products and services to its clients, the Westpac Group may act in several capacities (including issuer, market maker, underwriter, distributor, swap counterparty and calculation agent) simultaneously with respect to a financial instrument, giving rise to potential conflicts of interest which may impact the performance of a financial instrument. The Westpac Group may at any time transact or hold a position (including hedging and trading positions) for its own account or the account of a client in any financial instrument which may impact the performance of that financial instrument.

Author(s) disclaimer and declaration: The author(s) confirms that (a) no part of his/her compensation was, is, or will be, directly or indirectly, related to any views or (if applicable) recommendations expressed in this material; (b) this material accurately reflects his/her personal views about the financial products, companies or issuers (if applicable) and is based on sources reasonably believed to be reliable and accurate; (c) to the best of the author’s knowledge, they are not in receipt of inside information and this material does not contain inside information; and (d) no other part of the Westpac Group has made any attempt to influence this material.

Further important information regarding sustainability-related content: This material may contain statements relating to environmental, social and governance (ESG) topics. These are subject to known and unknown risks, and there are significant uncertainties, limitations, risks and assumptions in the metrics, modelling, data, scenarios, reporting and analysis on which the statements rely. In particular, these areas are rapidly evolving and maturing, and there are variations in approaches and common standards and practice, as well as uncertainty around future related policy and legislation. Some material may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. There is a risk that the analysis, estimates, judgements, assumptions, views, models, scenarios or projections used may turn out to be incorrect. These risks may cause actual outcomes to differ materially from those expressed or implied. The ESG-related statements in this material do not constitute advice, nor are they guarantees or predictions of future performance, and Westpac gives no representation, warranty or assurance (including as to the quality, accuracy or completeness of the statements). You should seek your own independent advice.

Additional country disclosures:

Australia: Westpac holds an Australian Financial Services Licence (No. 233714). You can access Westpac’s Financial Services Guide here or request a copy from your Westpac point of contact. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice.

New Zealand: In New Zealand, Westpac Institutional Bank refers to the brand under which products and services are provided by either Westpac (NZ division) or Westpac New Zealand Limited (company number 1763882), the New Zealand incorporated subsidiary of Westpac ("WNZL"). Any product or service made available by WNZL does not represent an offer from Westpac or any of its subsidiaries (other than WNZL). Neither Westpac nor its other subsidiaries guarantee or otherwise support the performance of WNZL in respect of any such product. WNZL is not an authorised deposit-taking institution for the purposes of Australian prudential standards. The current disclosure statements for the New Zealand branch of Westpac and WNZL can be obtained at the internet address www.westpac.co.nz.

Singapore: This material has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (as defined in the applicable Singapore laws and regulations) only. Recipients of this material in Singapore should contact Westpac Singapore Branch in respect of any matters arising from, or in connection with, this material. Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision by the Monetary Authority of Singapore.

Fiji: Unless otherwise specified, the products and services for Westpac Fiji are available from www.westpac.com.fj © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia and registered as a branch in Fiji. The liability of its members is limited.

Papua New Guinea: Unless otherwise specified, the products and services for Westpac PNG are available from www.westpac.com.pg © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia. Westpac is represented in Papua New Guinea by Westpac Bank - PNG - Limited. The liability of its members is limited.

U.S.: Westpac operates in the United States of America as a federally licensed branch, regulated by the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity Futures Trading Commission (“CFTC”) as a Swap Dealer, but is neither registered as, or affiliated with, a Futures Commission Merchant registered with the US CFTC. The services and products referenced above are not insured by the Federal Deposit Insurance Corporation (“FDIC”). Westpac Capital Markets, LLC (‘WCM’), a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities Exchange Act of 1934 (‘the Exchange Act’) and member of the Financial Industry Regulatory Authority (‘FINRA’). In accordance with APRA's Prudential Standard 222 'Association with Related Entities', Westpac does not stand behind WCM other than as provided for in certain legal agreements between Westpac and WCM and obligations of WCM do not represent liabilities of Westpac.

This communication is provided for distribution to U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors in the United States. WCM is the U.S. distributor of this communication and accepts responsibility for the contents of this communication. Transactions by U.S. customers of any securities referenced herein should be effected through WCM. All disclaimers set out with respect to Westpac apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein, please contact WCM on +1 212 389 1269. Investing in any non-U.S. securities or related financial instruments mentioned in this communication may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related financial instruments may be limited. Non-U.S. companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in effect in the United States. The value of any investment or income from any securities or related derivative instruments denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related derivative instruments.

The author of this communication is employed by Westpac and is not registered or qualified as a research analyst, representative, or associated person of WCM or any other U.S. broker-dealer under the rules of FINRA, any other U.S. self-regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically stated, the views expressed herein are solely those of the author and may differ from the information, views or analysis expressed by Westpac and/or its affiliates.

UK: The London branch of Westpac is authorised in the United Kingdom by the Prudential Regulation Authority (PRA) and is subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA (Financial Services Register number: 124586). The London branch of Westpac is registered at Companies House as a branch established in the United Kingdom (Branch No. BR000106). Details about the extent of the regulation of Westpac’s London branch by the PRA are available from us on request.

This communication is not being made to or distributed to, and must not be passed on to, the general public in the United Kingdom. Rather, this communication is being made only to and is directed at (a) those persons falling within the definition of Investment Professionals (set out in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”)); (b) those persons falling within the definition of high net worth companies, unincorporated associations etc. (set out in Article 49(2)of the Order; (c) other persons to whom it may lawfully be communicated in accordance with the Order or (d) any persons to whom it may otherwise lawfully be made (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. In the same way, the information contained in this communication is intended for “eligible counterparties” and “professional clients” as defined by the rules of the Financial Conduct Authority and is not intended for “retail clients”. Westpac expressly prohibits you from passing on the information in this communication to any third party.

European Economic Area (“EEA”): This material may be distributed to you by either: (i) Westpac directly, or (ii) Westpac Europe GmbH (“WEG”) under a sub-licensing arrangement. WEG has not edited or otherwise modified the content of this material. WEG is authorised in Germany by the Federal Financial Supervision Authority (‘BaFin’) and subject to its regulation. WEG’s supervisory authorities are BaFin and the German Federal Bank (‘Deutsche Bundesbank’). WEG is registered with the commercial register (‘Handelsregister’) of the local court of Frankfurt am Main under registration number HRB 118483. In accordance with APRA’s Prudential Standard 222 ‘Association with Related Entities’, Westpac does not stand behind WEG other than as provided for in certain legal agreements (a risk transfer, sub-participation and collateral agreement) between Westpac and WEG and obligations of WEG do not represent liabilities of Westpac. Any product or service made available by WEG does not represent an offer from Westpac or any of its subsidiaries (other than WEG). All disclaimers set out with respect to Westpac apply equally to WEG.

This communication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This communication contains general commentary, research, and market colour. The communication does not constitute investment advice. The material may contain an ‘investment recommendation’ and/or ‘information recommending or suggesting an investment’, both as defined in Regulation (EU) No 596/2014 (including as applicable in the United Kingdom) (“MAR”). In accordance with the relevant provisions of MAR, reasonable care has been taken to ensure that the material has been objectively presented and that interests or conflicts of interest of the sender concerning the financial instruments to which that information relates have been disclosed.

Investment recommendations must be read alongside the specific disclosure which accompanies them and the general disclosure which can be found here. Such disclosure fulfils certain additional information requirements of MAR and associated delegated legislation and by accepting this communication you acknowledge that you are aware of the existence of such additional disclosure and its contents.

To the extent this communication comprises an investment recommendation it is classified as non-independent research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and therefore constitutes a marketing communication. Further, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research.