Sustainable Finance Market Update Q3 2025

How did the sustainable finance market move in Q3 2025? Our October wrap covers notable transactions in Australia and New Zealand, the latest market insights, the first Australian Sustainable Finance Taxonomy-aligned Green Bond and more.

Market recap – September 2025 year to date

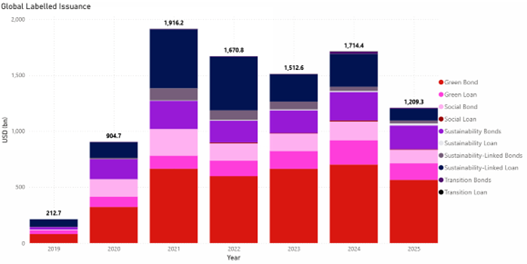

Figure 1 – Global Sustainable Finance Issuance by Year (2025 data to September). Source: Bloomberg/Westpac

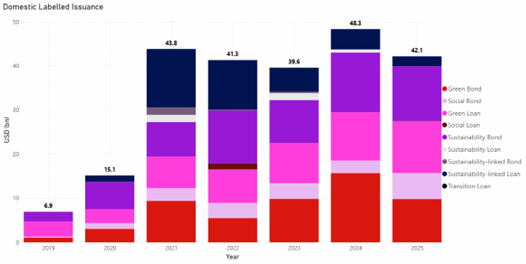

Figure 2 - Australian Sustainable Finance Issuance by Year (2025 data to September). Source: Bloomberg/Westpac

Global sustainable debt issuance totalled USD 1,209bn (Figure 1) for the 9 months to September 2025, marking a 9% decline from pcp (USD 1,331bn), but up 5% on the same period in 2023 (USD 1,151bn), according to Bloomberg. Conversely in Australia, issuance reached USD 42bn (Figure 2) for the same period, the highest year to date on record, eclipsing the yearly totals for 2023 and 2022.

Sustainable Bonds continued to dominate issuance, accounting for 77% (or USD 929bn) of total sustainable debt issuance in 2025 - the highest proportion on record.

- Green Bonds have had their strongest year, with issuance totalling USD 564bn through the first three quarters. The market is on track to surpass the previous annual record of USD 702bn set in 2024.

- Sustainability Bonds have also seen robust support, with USD 213bn issued year-to-date - on track to surpass the 2024 yearly total of USD 255bn.

- In Australia, Sustainable Bond issuance has mirrored the ongoing strength seen in the global market, reaching USD 28bn by the end of Q3, ahead of the previous two years. This has been underpinned by strong issuance of Sustainability Bonds, which contributed USD 12.5bn.

While Sustainable Bond issuance remains resilient, Sustainable Loans have continued to moderate globally. Global issuance totalled USD 280bn for the 9 months to September 2025, down 25% from pcp (USD 374bn) and flat to 2023 (USD 276bn). The Australian market has shown signs of resilience, with Sustainable Loan issuance reaching USD 16bn through the September 2025 quarter, despite global declines.

- Green Loans globally have remained relatively stable despite headwinds in other loan categories, with year-to-date Q3 issuance at USD 150bn, contributing to a record cumulative volume for the year.

- Sustainability-Linked Loans (SLLs) continue to face significant headwinds. Global SLL issuance fell to USD 106bn in through Q3 2025, the lowest since 2020.

- In Australia, Sustainable Loan activity has been largely concentrated in Green Loans, with USD 12bn issued to date, more than double that of pcp. Meanwhile, the SLL market has mirrored global trends, showing softer activity through 2025.

Notable Sustainable Finance Transactions in Q3 2025

Westpac was proud to support Bluecurrent as a Joint Sustainability Coordinator in securing a NZD 2.5bn Green Loan certified under the Climate Bonds Standard v4.2, building on its continued commitment to and investment in the energy transition through electricity smart metering and the expansion into digital water metering across Australia and New Zealand. Smart metering enables real-time monitoring, improved billing accuracy, and faster fault detection, helping utilities and consumers manage energy and water use more efficiently. The green loan follows their inaugural Climate Bonds Certified financing in 2023 with the loan certified under the Electrical Grids and Storage and Water Infrastructure sector criteria.

Westpac and Westpac New Zealand acted as Joint Sustainability Coordinators.

FRV Australia (Gnarwarre BESS) – Green Loan

FRV Australia has reached financial close on its largest Battery Energy Storage System (BESS) to date - the 250MW/500MWh Gnarwarre BESS in Victoria. Backed by a core lending group and financed under FRV’s portfolio financing, the project is a key enabler of grid stability and supports Australia’s clean energy transition. Australia’s BESS market continues to show strong momentum, with the 12-month quarterly average energy output of fully commissioned storage projects rising 39% in Q2 2025 to a record 584MWh, according to data from the Clean Energy Council. Despite a softer quarter, this marks the ninth consecutive quarter where newly financially committed storage projects have exceeded 1,000MWh in energy output. Once completed, the latest project will bring FRV’s total installed capacity to approximately 1.4GW.

Westpac acted as a Green Loan Coordinator.

Endeavour Energy – Sustainability-Linked Loan

Endeavour Energy secured AUD 2.065bn in financing under refreshed SLLs, reinforcing its strategic ambition to decarbonising the grid by 2035. The SLLs are tied to updated KPIs including a new Scope 3 emissions target and a nature-related KPI focused on net habitat gain, alongside waste and Scope 1 & 2 emissions KPIs. Endeavour Energy’s total sustainability-linked financing has surpassed AUD 3bn, which represents ~40% of their total debt. The refreshed financing builds on the inaugural SLL completed by Endeavour in 2022, when it became the first distribution network service provider in Australia to issue sustainability-linked financing.

Westpac was a lender.

ColCap Financial Group – Social Loan

In a milestone for social financing in Australia, ColCap Financial Group recently issued its first social Residential Mortgage-Backed Security (RMBS) tranche.

Supported by Specialist Disability Accommodation under the National Disability Insurance Scheme, the AUD 330m social tranche forms part of a broader AUD 1.2bn RMBS issuance. The social tranche is dedicated for purpose-built housing designed to meet the living and accessibility needs of people living with disabilities.

Westpac acted as Joint Lead Manager.

Eligible green and social projects in South Australia look set to benefit from the proceeds of a new AUD 1.5bn sustainability bond.

Westpac was proud to act as a Joint Lead Manager for the South Australian Government Financing Authority’s (SAFA) latest green finance instrument, which carries a coupon rate of 4.75% and a maturity date of May 2035.

Eligible green and social projects across the state include education, housing, health and water. The issuance reinforces SAFA’s leadership in the Australian sustainable finance market, where it claims to be the largest issuer of sustainability-labelled bonds.

Westpac acted as Joint Lead Manager.

Transpower has reinforced its commitment to a net-zero carbon transmission grid for New Zealand by successfully closing its dual green bond offering. Comprising an NZD 100m 5-year retail fixed rate bond and an NZD 125m 3-year wholesale floating rate bond, Westpac New Zealand was proud to act as the sole lead manager.

The dual tranche structure allowed Transpower to fund the gaps in its debt maturity profile and provide diversity of investment for both retail and wholesale investors. Transpower established its Green Financing Framework in 2022, which is programmatically certified by the Climate Bonds Initiative. There are currently 14 green bond issuances outstanding under the Framework.

Westpac New Zealand was the sole Lead Manager.

Across the Sector

Climate Bonds Initiative – Melbourne Event

Westpac was proud to host Sean Kidney, CEO of the Climate Bonds Initiative (CBI), at our Melbourne offices for an engaging and timely discussion with clients and investors. Sean shared valuable insights into the evolving global ESG and sustainable finance landscape, touching on key themes such as climate resilience, taxonomy developments, and the rise of labelled sovereign issuance. We thank Sean and the CBI team for continuing this annual tradition and our guests joining.

Sustainable loan report reveals strong local performance

The sustainable finance market is continuing to maintain healthy activity levels with the latest edition of Environmental Finance’s Sustainable Loans Insight revealing ongoing strength within the use of proceeds sector (green bonds and loans) while noticeable moderation in Sustainability-Linked instruments across the first half of 2025.

Published by Environmental Finance which captures loan data submitted to its platform, the 2025 report published in September highlights that renewable energy continued to lead the way for use-of-proceeds lending during FY2025, capturing more than half the value raised by these loans. Green buildings came in second, reflecting the real estate industry’s shift toward sustainable design.

SLL key performance indicators continued to be primarily focused on greenhouse gas emissions reductions, which was the most popular KPI by value and volume in FY2025. Gender equality KPIs are also becoming more common and were the most popular social KPI during the period.

Closer to home, the Asia-Pacific region recorded a stronger focus on renewable energy and green buildings, while Westpac ranked second in the Sustainability Coordinator league table for Oceania. And how is the Australian market tracking? The report shows the Australian dollar is the third most popular currency for sustainable loans (behind the US dollar and the Euro), which indicates a strong local market for the issuance of labelled debt.

Certification scheme introduces resilience

As the world continues to feel the impact of climate change, building resilience has become essential. This is reflected in the latest update to the Climate Bonds Standard and Certification Scheme (Climate Bonds V4.3), which includes a ‘Resilience Criteria’ for evaluating how well a project, asset or activity is designed to withstand, adapt to and thrive in the face of future climate impacts.

Developed in conjunction with the Climate Bonds Resilience Taxonomy and its related methodology, the criteria are particularly relevant for sectors where climate resilience is as critical as emissions reductions – these include infrastructure, water, agriculture, and the built environment.

Inclusion of resilience in the Climate Bonds Standard empowers market participants to support projects that not only cut emissions but also withstand and adapt to climate impacts. By enabling certification of projects that incorporate high-quality adaptation and resilience planning, the pipeline of investible climate solutions may expand at a time when they’re needed most.

ECB announces climate factor measure

In a bid to improve the management of climate-related financial risk, the European Central Bank (ECB) has announced significant reforms to its collateral framework. A new ‘climate factor’ measure, to be implemented in the second half of 2026, could reduce the value assigned to eligible assets used as collateral and could limit how much the Euro system is willing to lend against them.

Under the reform, the ECB will assign an uncertainty score to marketable assets from non-financial corporates used as collateral. This score will be derived from three components: sector-wide climate stress risks, issuer-specific climate performance, such as greenhouse gas emissions and disclosure quality, and asset-level vulnerability to future climate shocks.

The ECB’s new climate factor measure brings greater financial visibility to climate risk and sets a strong precedent that other central banks may be closely watching. For bond issuers and borrowers, the reform could mean higher costs or reduced access to funding if their assets are carbon intensive. For green financiers, it may boost demand for climate-aligned investments and validates ESG as a core financial metric.

Sustainable Finance Spotlight

Victorian Power Networks (VPN) has issued its inaugural green bond, marking the first Australian green bond to be aligned with the Australian Sustainable Finance Taxonomy, as well as being the first EU taxonomy aligned issuance for an Australian entity. Westpac acted as Joint Lead Manager and Green Structuring Adviser on the transaction and development of VPN’s Sustainable Financing Framework.

The AUD 750m dual-tranche transaction was issued in 6.5-year fixed and floating rate formats, attracting strong demand from fixed income investors with an orderbook exceeding AUD 2.45bn.

VPN’s decision to align the bond with the Australian Taxonomy was described by Alastair Graham, Head of Treasury, as a “natural addition” to their Green Bond Framework. He noted that the initial decision to offer a green bond was driven in part by investor demand for labelled securities from the electricity distribution sector and was backed by the deal group supporting the step to include Taxonomy alignment. As a result, VPN received significant and very positive feedback from investors.

Graham added that VPN felt confident in offering a green bond to the market, given the ongoing electrification focus of Victoria and the State Government’s ban on gas-connections in new homes and other measures to expediate the uptake of renewables and the commitment to reach net zero emissions by 2045.

Our own Sustainable Finance Director, Kirsty McCartney, commented that the value of taxonomy alignment centres around building trust with stakeholders, particularly investors, by demonstrating environmental integrity and credibility, which in turn supports risk mitigation, and can demonstrate market leadership. “Some investors have started asking about taxonomy alignment and it came up in pre-deal meetings…. [and that] anecdotally, some investors reported having larger bids for a highly credible green-bond product.”

This transaction represents a key step in financing Australia’s energy transition, with proceeds directed toward grid decarbonisation and renewable energy integration.

Sustainalytics provided the Second Party Opinion confirming alignment to the Green Bond Principles, while ISS-Corporate provided an external review confirming alignment with the technical screening criteria of the Australian Sustainable Finance Taxonomy.

The Sustainable finance team recommends

Stay informed with Westpac IQ

Get the latest reports straight to your inbox.

Browse topics

Disclaimer

©2026 Westpac Banking Corporation ABN 33 007 457 141 (including where acting under any of its Westpac, St George, Bank of Melbourne or BankSA brands, collectively, “Westpac”). References to the “Westpac Group” are to Westpac and its subsidiaries and includes the directors, employees and representatives of Westpac and its subsidiaries.

Things you should know

We respect your privacy: You can view the New Zealand Privacy Policy here, or the Australian Group Privacy Statement here. Each time someone visits our site, data is captured so that we can accurately evaluate the quality of our content and make improvements for you. We may at times use technology to capture data about you to help us to better understand you and your needs, including potentially for the purposes of assessing your individual reading habits and interests to allow us to provide suggestions regarding other reading material which may be suitable for you.

This information, unless specifically indicated otherwise, is under copyright of the Westpac Group. None of the material, nor its contents, nor any copy of it, may be altered in any way, transmitted to, copied of distributed to any other party without the prior written permission of the Westpac Group.

Disclaimer

This information has been prepared by Westpac and is intended for information purposes only. It is not intended to reflect any recommendation or financial advice and investment decisions should not be based on it. This information does not constitute an offer, a solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or to enter into a legally binding contract. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision.

This information may contain material provided by third parties. While such material is published with the necessary permission none of Westpac or its related entities accepts any responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure this information is free from error, none of Westpac or its related entities warrants the accuracy, adequacy or completeness of this information, or otherwise endorses it in any way. Except where contrary to law, Westpac Group intend by this notice to exclude liability for this information. This information is subject to change without notice and none of Westpac or its related entities is under any obligation to update this information or correct any inaccuracy which may become apparent at a later date. This information may contain or incorporate by reference forward-looking statements. The words “believe”, “anticipate”, “expect”, “intend”, “plan”, “predict”, “continue”, “assume”, “positioned”, “may”, “will”, “should”, “shall”, “risk” and other similar expressions that are predictions of or indicate future events and future trends identify forward-looking statements. These forward-looking statements include all matters that are not historical facts. Past performance is not a reliable indicator of future performance, nor are forecasts of future performance. Whilst every effort has been taken to ensure that the assumptions on which any forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from any forecasts.

Conflicts of Interest: In the normal course of offering banking products and services to its clients, the Westpac Group may act in several capacities (including issuer, market maker, underwriter, distributor, swap counterparty and calculation agent) simultaneously with respect to a financial instrument, giving rise to potential conflicts of interest which may impact the performance of a financial instrument. The Westpac Group may at any time transact or hold a position (including hedging and trading positions) for its own account or the account of a client in any financial instrument which may impact the performance of that financial instrument.

Author(s) disclaimer and declaration: The author(s) confirms that (a) no part of his/her compensation was, is, or will be, directly or indirectly, related to any views or (if applicable) recommendations expressed in this material; (b) this material accurately reflects his/her personal views about the financial products, companies or issuers (if applicable) and is based on sources reasonably believed to be reliable and accurate; (c) to the best of the author’s knowledge, they are not in receipt of inside information and this material does not contain inside information; and (d) no other part of the Westpac Group has made any attempt to influence this material.

Further important information regarding sustainability-related content: This material may contain statements relating to environmental, social and governance (ESG) topics. These are subject to known and unknown risks, and there are significant uncertainties, limitations, risks and assumptions in the metrics, modelling, data, scenarios, reporting and analysis on which the statements rely. In particular, these areas are rapidly evolving and maturing, and there are variations in approaches and common standards and practice, as well as uncertainty around future related policy and legislation. Some material may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. There is a risk that the analysis, estimates, judgements, assumptions, views, models, scenarios or projections used may turn out to be incorrect. These risks may cause actual outcomes to differ materially from those expressed or implied. The ESG-related statements in this material do not constitute advice, nor are they guarantees or predictions of future performance, and Westpac gives no representation, warranty or assurance (including as to the quality, accuracy or completeness of the statements). You should seek your own independent advice.

Additional country disclosures:

Australia: Westpac holds an Australian Financial Services Licence (No. 233714). You can access Westpac’s Financial Services Guide here or request a copy from your Westpac point of contact. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice.

New Zealand: In New Zealand, Westpac Institutional Bank refers to the brand under which products and services are provided by either Westpac (NZ division) or Westpac New Zealand Limited (company number 1763882), the New Zealand incorporated subsidiary of Westpac ("WNZL"). Any product or service made available by WNZL does not represent an offer from Westpac or any of its subsidiaries (other than WNZL). Neither Westpac nor its other subsidiaries guarantee or otherwise support the performance of WNZL in respect of any such product. WNZL is not an authorised deposit-taking institution for the purposes of Australian prudential standards. The current disclosure statements for the New Zealand branch of Westpac and WNZL can be obtained at the internet address www.westpac.co.nz.

Singapore: This material has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (as defined in the applicable Singapore laws and regulations) only. Recipients of this material in Singapore should contact Westpac Singapore Branch in respect of any matters arising from, or in connection with, this material. Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision by the Monetary Authority of Singapore.

Fiji: Unless otherwise specified, the products and services for Westpac Fiji are available from www.westpac.com.fj © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia and registered as a branch in Fiji. The liability of its members is limited.

Papua New Guinea: Unless otherwise specified, the products and services for Westpac PNG are available from www.westpac.com.pg © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia. Westpac is represented in Papua New Guinea by Westpac Bank - PNG - Limited. The liability of its members is limited.

U.S.: Westpac operates in the United States of America as a federally licensed branch, regulated by the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity Futures Trading Commission (“CFTC”) as a Swap Dealer, but is neither registered as, or affiliated with, a Futures Commission Merchant registered with the US CFTC. The services and products referenced above are not insured by the Federal Deposit Insurance Corporation (“FDIC”). Westpac Capital Markets, LLC (‘WCM’), a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities Exchange Act of 1934 (‘the Exchange Act’) and member of the Financial Industry Regulatory Authority (‘FINRA’). In accordance with APRA's Prudential Standard 222 'Association with Related Entities', Westpac does not stand behind WCM other than as provided for in certain legal agreements between Westpac and WCM and obligations of WCM do not represent liabilities of Westpac.

This communication is provided for distribution to U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors in the United States. WCM is the U.S. distributor of this communication and accepts responsibility for the contents of this communication. Transactions by U.S. customers of any securities referenced herein should be effected through WCM. All disclaimers set out with respect to Westpac apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein, please contact WCM on +1 212 389 1269. Investing in any non-U.S. securities or related financial instruments mentioned in this communication may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related financial instruments may be limited. Non-U.S. companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in effect in the United States. The value of any investment or income from any securities or related derivative instruments denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related derivative instruments.

The author of this communication is employed by Westpac and is not registered or qualified as a research analyst, representative, or associated person of WCM or any other U.S. broker-dealer under the rules of FINRA, any other U.S. self-regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically stated, the views expressed herein are solely those of the author and may differ from the information, views or analysis expressed by Westpac and/or its affiliates.

UK: The London branch of Westpac is authorised in the United Kingdom by the Prudential Regulation Authority (PRA) and is subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA (Financial Services Register number: 124586). The London branch of Westpac is registered at Companies House as a branch established in the United Kingdom (Branch No. BR000106). Details about the extent of the regulation of Westpac’s London branch by the PRA are available from us on request.

This communication is not being made to or distributed to, and must not be passed on to, the general public in the United Kingdom. Rather, this communication is being made only to and is directed at (a) those persons falling within the definition of Investment Professionals (set out in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”)); (b) those persons falling within the definition of high net worth companies, unincorporated associations etc. (set out in Article 49(2)of the Order; (c) other persons to whom it may lawfully be communicated in accordance with the Order or (d) any persons to whom it may otherwise lawfully be made (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. In the same way, the information contained in this communication is intended for “eligible counterparties” and “professional clients” as defined by the rules of the Financial Conduct Authority and is not intended for “retail clients”. Westpac expressly prohibits you from passing on the information in this communication to any third party.

European Economic Area (“EEA”): This material may be distributed to you by either: (i) Westpac directly, or (ii) Westpac Europe GmbH (“WEG”) under a sub-licensing arrangement. WEG has not edited or otherwise modified the content of this material. WEG is authorised in Germany by the Federal Financial Supervision Authority (‘BaFin’) and subject to its regulation. WEG’s supervisory authorities are BaFin and the German Federal Bank (‘Deutsche Bundesbank’). WEG is registered with the commercial register (‘Handelsregister’) of the local court of Frankfurt am Main under registration number HRB 118483. In accordance with APRA’s Prudential Standard 222 ‘Association with Related Entities’, Westpac does not stand behind WEG other than as provided for in certain legal agreements (a risk transfer, sub-participation and collateral agreement) between Westpac and WEG and obligations of WEG do not represent liabilities of Westpac. Any product or service made available by WEG does not represent an offer from Westpac or any of its subsidiaries (other than WEG). All disclaimers set out with respect to Westpac apply equally to WEG.

This communication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This communication contains general commentary, research, and market colour. The communication does not constitute investment advice. The material may contain an ‘investment recommendation’ and/or ‘information recommending or suggesting an investment’, both as defined in Regulation (EU) No 596/2014 (including as applicable in the United Kingdom) (“MAR”). In accordance with the relevant provisions of MAR, reasonable care has been taken to ensure that the material has been objectively presented and that interests or conflicts of interest of the sender concerning the financial instruments to which that information relates have been disclosed.

Investment recommendations must be read alongside the specific disclosure which accompanies them and the general disclosure which can be found here. Such disclosure fulfils certain additional information requirements of MAR and associated delegated legislation and by accepting this communication you acknowledge that you are aware of the existence of such additional disclosure and its contents.

To the extent this communication comprises an investment recommendation it is classified as non-independent research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and therefore constitutes a marketing communication. Further, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research.