Sustainable Finance Q3 2023 Market Update

Welcome to Westpac IQ’s quarterly sustainable finance market update.

Sustainable debt market update

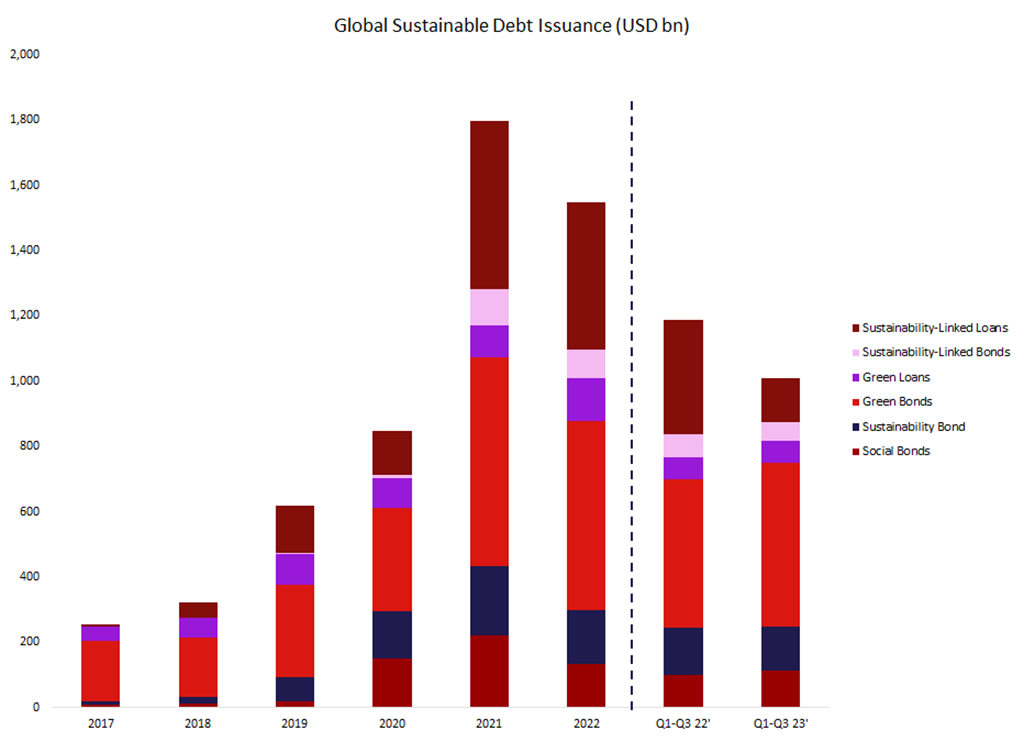

Global observations

Source for graphs and observations: BloombergNEF as at 30 September 2023. Noting data excludes Social and Sustainability Loans.

Global sustainable debt issuance totalled USD 1,010bn during Q1-Q3 2023, down 15% on PCP (Q1-Q3 2022), with continued stronger momentum in Sustainable Bond issuance not enough to offset the softer Sustainable Loan market.

Sustainable Bond issuance exceeded pcp (Q1-Q3 2022) by 5% despite a softer Q3 with less sovereign and supranational issuances (a previous driver of the half year volumes). Issuance continues to be dominated by Green Bonds which are tracking ahead of PCP volumes (+11%) and making up half of the total global Sustainable Debt issued this year. Social Bonds also continue to contribute favourably, up 12% on pcp. In light of this, Moody’s Investor Services revised its Sustainable Debt forecast as it estimates that 2023 Sustainable Bond issuance could ‘eclipse’ its initial USD 950bn forecast, notably forecasting increasing issuance from carbon-intensive sectors.

However, this was offset by the decrease in the Sustainable Loan market which continued to see muted issuance through Q1-Q3 when compared to PCP, namely due to reduced volumes of Sustainability-Linked Loans (-61%), with Green Loans only nominally down (-5%).

While Sustainable Debt volumes have remained subdued for the year to 30 September, possibly due to heightened scrutiny of potential greenwashing and an increasingly complex ESG regulatory and political landscape, the formalisation of more comprehensive decarbonisation plans by a growing number of issuers supports long-term Sustainable Debt growth.

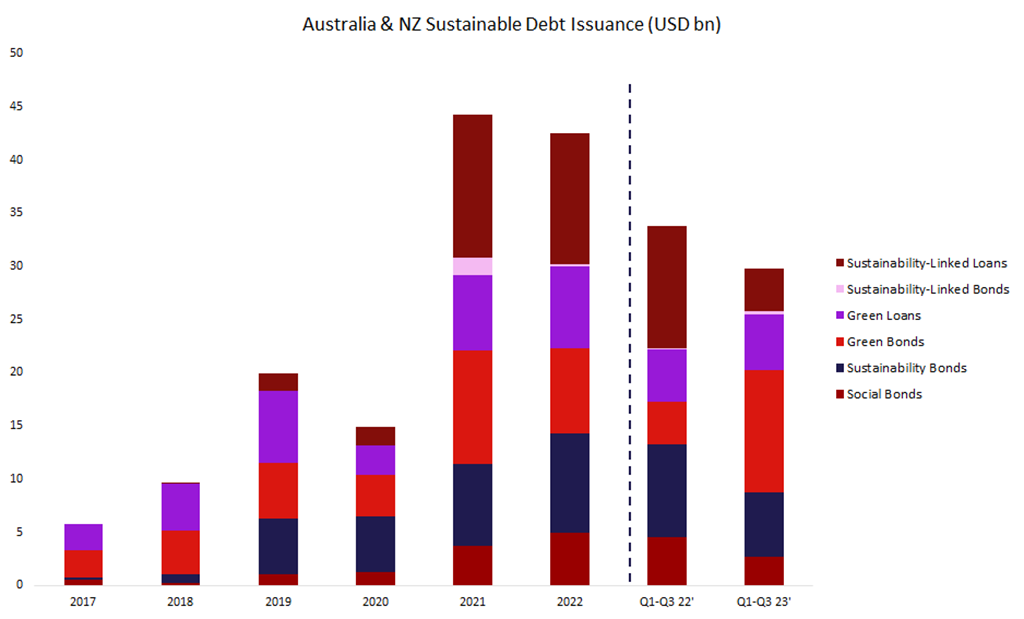

Australia-New Zealand observations

Source for graphs and observations: BloombergNEF as at 30 September 2023. Noting data excludes Social and Sustainability Loans. Australia & New Zealand volumes based off issuer currency (AUD and NZD).

Australia-New Zealand sustainable debt issuance totalled USD 30bn during Q1-Q3 2023, down 12% on PCP (Q1-Q3 2022), despite a stronger Q3 which exceeded pcp (Q3 2022) by 48%.

Aligned to the global market, Sustainable Bonds have dominated Sustainable Debt issuance in the Australia-New Zealand market this year, with Green Bonds contributing USD 11.5bn / 37% of total issuance year to date, up 188% on PCP, continuing the strongest year to date contribution from the instrument that was seen in the first half performance. This was driven by sovereign, supranational and government issuances, which contributed 82% to overall Sustainable Bond issuances.

In terms of Sustainable Loan volumes, Sustainability-Linked Loans rebounded slightly in Q3 2023, with USD 2.7bn issuance over the quarter, surpassing the total USD 1.3bn executed over Q1-Q2 2023 and USD 0.5bn in pcp (Q3 2022). However these volumes are still expected to have been impacted by borrowers reviewing the robustness of their ESG data, commitments and processes off the back of significantly higher regulatory / media focus on greenwashing before linking their ESG commitments into their financing structures.

Notable use of proceeds and sustainability-linked issuances

Use of proceeds issuances

Infrashore (Social Loan) - Westpac supported Infrashore’s, an SPV owned by the Dexus Community Infrastructure Fund (CommIF), inaugural AUD448.2m Social Loan as Sustainability Coordinator in the refinance of its PPP for Royal North Shore Hospital (“RNSH”). The Social Loan builds on CommIF’s commitment to deliver on the long-term investment objectives for positive social outcomes for communities which the Funds invest in; the RNSH Project in particular elevated the provision of essential healthcare services, establish critical social infrastructure, support the Aboriginal and Torres Strait Islander, and LGBTIQ community. Westpac acted as Joint Sustainability Coordinator.

NBN Co (Green Bond) – NBN has successfully raised AUD 850m in a new five-year benchmark, positioning the company as the largest corporate bond issuer in Australia. The net proceeds will be fully allocated to eligible green projects undertaken as part of the company’s commitment to energy efficiency. The latest debt raising follows the company’s release of its second Sustainability Bond Report in August. Westpac acted as a Joint Lead Manager Press release.

PFI (Green Loan) - PFI signed its inaugural NZD150m of Green Loan tranches alongside publication of its Green Finance Framework. The Green Loan proceeds will support the development of properties targeting 5 Green Star Design and Built ratings. Westpac acted as Joint Sustainability Coordinator Press Release

La Trobe University (Green Bond) – La Trobe University issued its inaugural Green Bond to fund a diverse range of eligible eco-friendly projects and initiatives in areas such as renewable energy, green buildings, sustainable water and waste management and terrestrial and aquatic biodiversity and conservation. Press Release.

Sustainability-Linked Issuances

Australian Unity (Sustainability-Linked Loan) – Australian Unity executed an AUD 50m SLL connected to the groups Community & Social Value Framework (CSV Framework) and annual social impact performance. The financing instrument is linked to Australian Unity’s material delivery of wellbeing outcomes as measured by the CSV Framework and will be available to support the group’s general funding needs and investments that drive CSV value and ongoing wellbeing initiatives. Westpac acted as Sole Sustainability Coordinator Press Release.

Queenstown Airport (Sustainability-Linked Loan) - In July Queenstown Airport established its inaugural Sustainability-Linked Loans totalling $100m. Targets included achieving Level 4 Airport Carbon Accreditation, reducing Scope 1 and 2 greenhouse gas emissions, installing infrastructure that supports reductions in Queenstown Airport’s Scope 3 greenhouse gas emissions, and reducing specific waste streams sent to landfill across the terminal precinct. Westpac NZ acted as Joint Sustainability Coordinator. Press Release.

Port of Melbourne (Sustainability-Linked Loan) – Port of Melbourne completed an AUD 475m SLL linked to two sustainability indicators covering scope 1 and 2 emissions reduction, and a mental health first aid workplace certification, together with an overarching gateway target tied to engagement with port stakeholders to facilitate scope 3 emissions reduction. CEO Saul Cannon said the deal reflected Port of Melbourne’s goal of working with stakeholders to build a sustainable port for the benefit of the Victorian economy and liveability of Melbourne. Press Release.

Macquarie University (Sustainability-Linked Loan) – Macquarie University established an AUD 450m SLL, linked to six KPIs, including: scope 1 and 2 emissions reduction; scope 3 emissions measurement and future target setting; biodiversity / restoration of critically endangered forest; student and staff training on Manawari and the Sustainable Development Goals; gender equality aligned to WGEA’s 40:40 vision; and widening participation in stem. Press release.

Regulatory, standards and policy developments

Australia - New Zealand

AASB releases exposure draft for the first draft Australian Sustainability Reporting Standards (ASRS) on Disclosure of Climate-related Financial Information

TThe AASB has released an exposure draft of standards that it proposes would apply to annual reporting periods beginning on or after 1 July 2024. Treasury is yet to release its position paper (following its second consultation in June 2023) to provide clarity on which entities will be in scope of the ASRS Standards and when. AASB is seeking feedback on the proposed standards until 1 March 2024. AASB Oct 2023.

Australian Federal Government considering adoption of a cross-border adjustment mechanism

The federal government is weighing up the adoption of a cross-border adjustment mechanism (CBAM) – or ‘green tariff’ – to avoid disadvantaging domestic companies in industries like steel and cement that may be subject to the Australian safeguard mechanisms. The move would see Australia follow the European Union by imposing tariffs on some imports from nations with less ambitious climate goals. AFR Aug 2023.

Australian Sustainable Finance Institute (ASFI) Announces the Taxonomy Technical Expert Group

ASFI commenced the development phase of the Australian sustainable finance taxonomy with the appointment of the independent Taxonomy Technical Expert Group, which includes twenty-five senior leaders, and will provide strategic direction over, input into and endorsement of an Australian sustainable finance taxonomy for consideration by government. The taxonomy project is a joint government-industry initiative that will provide a common standard for green and transition finance, helping accelerate the allocation of capital towards sustainable activities to achieve Australia’s net-zero ambitions. ASFI August 2023.

International

Final Taskforce on Nature-related Financial Disclosures Recommendations are published

The Taskforce on Nature-related Financial Disclosures (TNFD) released a final risk management and disclosure framework which seek to identity, assess, and manage nature-related financial risks and opportunities. The Framework is expected to be integrated into accounting standards via the International Sustainability Standards Board (ISSB). TNFD Sept 2023.

The US Securities and Exchange Commission (SEC) finalises amendment to the Names Rule, capturing ESG Funds

The Names Rule reflects a basic idea that a fund’s investment portfolio should match a fund’s advertised investment focus. The amendment requires funds with a specific named focus (e.g. “sustainable” or “green”) to ensure 80% of assets by value are allocated to that focus area. Additionally, the Names Rule has been expanded to require transparency around a fund's investment methods. The SEC will require a fund to clearly define the terms it uses, how it selects relevant investments in line with that philosophy, and what current portfolio assets meet those criteria to therefore fulfil its 80% obligation. SEC 2023.

EU to ban generic environmental claims

EU announced it will ban sweeping environmental claims such as “climate neutral”, “environmentally friendly”, “natural”, “biodegradable” or “eco” by 2026 unless companies can prove the claim is accurate and ban sustainability labels not based on approved certification schemes or established by public authorities. The agreement updates the existing EU list of banned commercial practices to mitigate risk of greenwashing in marketing. EU Parliament Sept 2023.

California state passes the Greenhouse Gas Reporting Bill and the Climate Risk Reporting Bill

The Greenhouse Gas Reporting Bill requires companies with more than USD 1bn in annual revenue that operate in California to disclose Scope 1 and 2 emissions annually from 2027, and Scope 3 emissions in 2027 with limited assurance required from 2030. Additionally, companies operating in California with operating revenue greater than USD 500m will be required to report climate-related financial risk every other year, commencing from 2026, under the Climate Risk Reporting Bill. BBC Oct 2023.

The British government published pricing tiers for statutory biodiversity credits as part of its upcoming Biodiversity Net Gain legislation.

Biodiversity credits are emerging as valuable economic instruments to finance activities that deliver net positive results for the environment. A biodiversity market legislation has already been introduced in Australia under the Nature Repair Market Bill 2023 (Cth), largely in response to the 2021 State of the Environment Report, which painted a dire picture of the health of the country’s environment. Overseas, as part of its upcoming Biodiversity Net Gain legislation, the UK Government has proposed for developers to buy statutory biodiversity credits as a last resort option if they are unable to use on-site or off-site units to deliver a biodiversity net gain. The revenue from the sale of these biodiversity credits will be used to invest in habitat creation projects and administer the programme. UK Govt Aug 2023.

EU establishes carbon tax on ships

European Union is phasing in an emissions surcharge for all ships into EU ports. EU ports will levy 50% of CO2 emissions from voyages that start or end at EU ports, or 100% of emissions that occur between two EU ports. The new rules will be phased in over the next few years. Shipping companies must buy and surrender allowances of 40% of applicable emissions next year, 70% from 2025, and 100% from 2027. Business Desk Sept 2023.

Sustainable finance news

Australia-New Zealand

Reserve Bank of Australia Deputy Governor gives speech on Climate Change and Central Banks

The speech concluded that ‘Climate change has macroeconomic implications that are relevant for the setting of monetary policy and the Reserve Bank’s financial stability remit’, noting that while there are some familiar elements, ‘some are new – in particular, the heightened uncertainty around how the climate will change and how this will impact the economy and financial system.’ They also noted that they are “monitoring and analysing climate-related investment trends and their implications for the cost and availability of green and sustainable finance in Australia.” Climate Change and Central Banks | Speeches | RBA

Reserve Bank of Australia released Bulletin on Green and Sustainable Finance in Australia

The RBA released a Bulletin discussing the financial market developments in Australia that are working to address the issues surrounding the significant amounts of investment and financing required as we move away from a carbon-intensive economy in Australia to achieve our net zero greenhouse gas emissions by 2050. Specifically, the markets for green bonds, green loans and securitisations, and ethical equity funds. It noted that “Further development of these markets, along with Australia’s sustainable finance framework, will be important for the transition to a lower emissions economy”. Green and Sustainable Finance in Australia | Bulletin – September 2023 | RBA

Commonwealth to disclose Climate risks in Sovereign Bonds

It was reported by The Guardian that the Australian government agreed to settle what has been described as a world-first court case that accused it of misleading investors by failing to disclose the financial risk caused by the climate crisis. In 2020, a university student launched a class action accusing the then Morrison government of breaching a legal duty and deceiving investors in sovereign bonds by not informing them upfront of the climate risk they faced. The Albanese government agreed to publish a statement on a Treasury website acknowledging that climate change was a systemic risk that may affect bond value. Source: The Guardian

New Zealand’s greenhouse gas emissions at a historic low

New Zealand is set to announce its lowest emissions this century based on latest emissions date from the Ministry of Business, Innovation and Employment (MBIE). Contributing to this was the 12-month renewable share of electricity topped 90% for the first time since December 1981 and emissions from burning fossil fuels are now at their lowest level since June 1999. Source Carbon News Sept 2023.

Change in New Zealand Government could lead to changes in climate policy

The National Party won the largest number of seats in Parliament in the October 2023 General Election in New Zealand Due to the MMP electoral system, in order to secure a majority, the National Party is still in negotiations with the Act party and New Zealand First party. National has acknowledged it wants to take a bi-partisan approach to climate change and stated it intends to maintain the Zero Carbon legislative targets and international climate pledges, with a focus on super-charging renewable energy and EV charging infrastructure. This differs to ACT which campaigned on repealing the Zero Carbon legislation, albeit without making it a coalition negotiation bottom line. National also campaigned on a policy to remove the Clean Car Discount and remove the Climate Emergency Response Fund (which diverts revenue from ETS auctions on policies to reduce emissions) and instead use the revenue from the ETS for tax cuts. Methane targets and pricing continues to be up for debate. RNZ Oct 2023.

KangaNews Sustainable Finance H2 2023

Coverage in the H2 2023 edition includes perspectives on the next phase of Australian energy transition, efforts to incorporate biodiversity and social considerations, investor preferences in Australian ESG fixed income, and the scale and impact of Australian EV uptake. KangaNews Sustainable Finance H2 2023

International

Investors call for mandatory reporting of climate transition plans

The Australian Government recently announced they will be setting climate targets and pathways for the biggest sectors in the economy, which means that many Australian businesses will transform their operations, will need to tell investors and other stakeholders how they’re planning to do so, and what capital support they need. Three networks of investors who manage more than $150 trillion, Investor Group on Climate Change, UN-supported Principles for Responsible Investment, and Carbon Disclosure Project, have issued a joint statement saying that the current lack of standardisation and regulatory guidance means most companies’ disclosure of their plans for managing the transition to net zero is incomplete or inadequate for investor needs. IGCC Sep 2023

Hottest months ever recorded

July – September 2023 were recorded as the hottest months ever on record with September being equivalent of 1.8 degrees warmer than pre-industrial levels and 0.5 degrees hotter than the previous record for that month - the largest jump in temperature ever seen. Scientists predict that 2023 will be the hottest on record and 2024 may even exceed that. Guardian Oct 2023.

International Energy Agency (IEA) publish the Net Zero Roadmap – A Global Pathway to Keep the 1.5 degree Goal in Reach, 2023 Update

The 2023 update draws on the latest data and analysis to map out what the global energy sector would need to do, especially in the crucial period between now and 2030, to play its part in keeping the 1.5 °C goal in reach. The IEA state that while the global pathway to net zero by 2050 mapped out previously in the 2021 report has narrowed, it is still achievable. The report also emphasises that net zero by 2050 globally doesn’t mean net zero by 2050 for every country. In the proposed pathway, advanced economies reach net zero sooner to allow emerging and developing economies more time. IEA Sept 2023.

ICMA publish Market Integrity and Greenwashing Risks in Sustainable Finance paper

The ICMA has released a new paper on market integrity and greenwashing risks in sustainable finance to promote constructive conversation between key stakeholders regarding the issue of greenwashing. This aims to strike a balance between addressing the problem without leading to market complacency or excessive regulatory measures. In addition the paper includes recommendations to policymakers and regulators to support the mitigation of greenwashing. ICMA Oct 2023.

ICMA Sustainability-Linked Bond (SLB) Principles, Q&A and Blue Bonds Guidance

The ICMA published the Q&As related to SLBs to complement the SLB Principles. The Q&As are designed to support issuers to understand how to embrace SLBs and look at ways of demonstrating their ambition and increase their accountability, while strengthening the credibility of the SLB market. ICMA Sept 2023.

Additionally, ICMA, together with the International Finance Corporation and the Asian Development Bank, developed a global practitioners guide for Blue Bonds to support issuers and investors with guidance on the key components involved in launching a credible blue bond for the protection and conservation of marine ecosystems. ICMA Sept 2023.

Westpac publications and media

Westpac Head of Energy, Infrastructure & Resources David Scrivener – Pressure testing Australia’s hydrogen dream Oct 2023

Westpac IQ Thought Leadership covering biodiversity, hydrogen, reimagining power stations, and offshore wind.

Westpac Wire Promoting wellbeing is good business at this modern mutual Sep 2023

Westpac hosted a Sustainable finance roundtable in partnership with KangaNews on how Social linkage shakes the foundations – and validity – of ESG

Contact our sustainable finance team

Australia: Eliza Mathews - Head of Sustainable Finance, Australia

New Zealand: Joanna Silver - Head of Sustainable Finance, New Zealand

Stay informed with Westpac IQ

Get the latest reports straight to your inbox.

Browse topics

Disclaimer

©2025 Westpac Banking Corporation ABN 33 007 457 141 (including where acting under any of its Westpac, St George, Bank of Melbourne or BankSA brands, collectively, “Westpac”). References to the “Westpac Group” are to Westpac and its subsidiaries and includes the directors, employees and representatives of Westpac and its subsidiaries.

Things you should know

We respect your privacy: You can view the New Zealand Privacy Policy here, or the Australian Group Privacy Statement here. Each time someone visits our site, data is captured so that we can accurately evaluate the quality of our content and make improvements for you. We may at times use technology to capture data about you to help us to better understand you and your needs, including potentially for the purposes of assessing your individual reading habits and interests to allow us to provide suggestions regarding other reading material which may be suitable for you.

This information, unless specifically indicated otherwise, is under copyright of the Westpac Group. None of the material, nor its contents, nor any copy of it, may be altered in any way, transmitted to, copied of distributed to any other party without the prior written permission of the Westpac Group.

Disclaimer

This information has been prepared by Westpac and is intended for information purposes only. It is not intended to reflect any recommendation or financial advice and investment decisions should not be based on it. This information does not constitute an offer, a solicitation of an offer, or an inducement to subscribe for, purchase or sell any financial instrument or to enter into a legally binding contract. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. We recommend that you seek your own independent legal or financial advice before proceeding with any investment decision.

This information may contain material provided by third parties. While such material is published with the necessary permission none of Westpac or its related entities accepts any responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure this information is free from error, none of Westpac or its related entities warrants the accuracy, adequacy or completeness of this information, or otherwise endorses it in any way. Except where contrary to law, Westpac Group intend by this notice to exclude liability for this information. This information is subject to change without notice and none of Westpac or its related entities is under any obligation to update this information or correct any inaccuracy which may become apparent at a later date. This information may contain or incorporate by reference forward-looking statements. The words “believe”, “anticipate”, “expect”, “intend”, “plan”, “predict”, “continue”, “assume”, “positioned”, “may”, “will”, “should”, “shall”, “risk” and other similar expressions that are predictions of or indicate future events and future trends identify forward-looking statements. These forward-looking statements include all matters that are not historical facts. Past performance is not a reliable indicator of future performance, nor are forecasts of future performance. Whilst every effort has been taken to ensure that the assumptions on which any forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from any forecasts.

Conflicts of Interest: In the normal course of offering banking products and services to its clients, the Westpac Group may act in several capacities (including issuer, market maker, underwriter, distributor, swap counterparty and calculation agent) simultaneously with respect to a financial instrument, giving rise to potential conflicts of interest which may impact the performance of a financial instrument. The Westpac Group may at any time transact or hold a position (including hedging and trading positions) for its own account or the account of a client in any financial instrument which may impact the performance of that financial instrument.

Author(s) disclaimer and declaration: The author(s) confirms that (a) no part of his/her compensation was, is, or will be, directly or indirectly, related to any views or (if applicable) recommendations expressed in this material; (b) this material accurately reflects his/her personal views about the financial products, companies or issuers (if applicable) and is based on sources reasonably believed to be reliable and accurate; (c) to the best of the author’s knowledge, they are not in receipt of inside information and this material does not contain inside information; and (d) no other part of the Westpac Group has made any attempt to influence this material.

Further important information regarding sustainability-related content: This material may contain statements relating to environmental, social and governance (ESG) topics. These are subject to known and unknown risks, and there are significant uncertainties, limitations, risks and assumptions in the metrics, modelling, data, scenarios, reporting and analysis on which the statements rely. In particular, these areas are rapidly evolving and maturing, and there are variations in approaches and common standards and practice, as well as uncertainty around future related policy and legislation. Some material may include information derived from publicly available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. There is a risk that the analysis, estimates, judgements, assumptions, views, models, scenarios or projections used may turn out to be incorrect. These risks may cause actual outcomes to differ materially from those expressed or implied. The ESG-related statements in this material do not constitute advice, nor are they guarantees or predictions of future performance, and Westpac gives no representation, warranty or assurance (including as to the quality, accuracy or completeness of the statements). You should seek your own independent advice.

Additional country disclosures:

Australia: Westpac holds an Australian Financial Services Licence (No. 233714). You can access Westpac’s Financial Services Guide here or request a copy from your Westpac point of contact. To the extent that this information contains any general advice, it has been prepared without taking into account your objectives, financial situation or needs and before acting on it you should consider the appropriateness of the advice.

New Zealand: In New Zealand, Westpac Institutional Bank refers to the brand under which products and services are provided by either Westpac (NZ division) or Westpac New Zealand Limited (company number 1763882), the New Zealand incorporated subsidiary of Westpac ("WNZL"). Any product or service made available by WNZL does not represent an offer from Westpac or any of its subsidiaries (other than WNZL). Neither Westpac nor its other subsidiaries guarantee or otherwise support the performance of WNZL in respect of any such product. WNZL is not an authorised deposit-taking institution for the purposes of Australian prudential standards. The current disclosure statements for the New Zealand branch of Westpac and WNZL can be obtained at the internet address www.westpac.co.nz.

Singapore: This material has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (as defined in the applicable Singapore laws and regulations) only. Recipients of this material in Singapore should contact Westpac Singapore Branch in respect of any matters arising from, or in connection with, this material. Westpac Singapore Branch holds a wholesale banking licence and is subject to supervision by the Monetary Authority of Singapore.

Fiji: Unless otherwise specified, the products and services for Westpac Fiji are available from www.westpac.com.fj © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia and registered as a branch in Fiji. The liability of its members is limited.

Papua New Guinea: Unless otherwise specified, the products and services for Westpac PNG are available from www.westpac.com.pg © Westpac Banking Corporation ABN 33 007 457 141. This information does not take your personal circumstances into account and before acting on it you should consider the appropriateness of the information for your financial situation. Westpac Banking Corporation ABN 33 007 457 141 is incorporated in NSW Australia. Westpac is represented in Papua New Guinea by Westpac Bank - PNG - Limited. The liability of its members is limited.

U.S.: Westpac operates in the United States of America as a federally licensed branch, regulated by the Office of the Comptroller of the Currency. Westpac is also registered with the US Commodity Futures Trading Commission (“CFTC”) as a Swap Dealer, but is neither registered as, or affiliated with, a Futures Commission Merchant registered with the US CFTC. The services and products referenced above are not insured by the Federal Deposit Insurance Corporation (“FDIC”). Westpac Capital Markets, LLC (‘WCM’), a wholly-owned subsidiary of Westpac, is a broker-dealer registered under the U.S. Securities Exchange Act of 1934 (‘the Exchange Act’) and member of the Financial Industry Regulatory Authority (‘FINRA’). In accordance with APRA's Prudential Standard 222 'Association with Related Entities', Westpac does not stand behind WCM other than as provided for in certain legal agreements between Westpac and WCM and obligations of WCM do not represent liabilities of Westpac.

This communication is provided for distribution to U.S. institutional investors in reliance on the exemption from registration provided by Rule 15a-6 under the Exchange Act and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors in the United States. WCM is the U.S. distributor of this communication and accepts responsibility for the contents of this communication. Transactions by U.S. customers of any securities referenced herein should be effected through WCM. All disclaimers set out with respect to Westpac apply equally to WCM. If you would like to speak to someone regarding any security mentioned herein, please contact WCM on +1 212 389 1269. Investing in any non-U.S. securities or related financial instruments mentioned in this communication may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the SEC in the United States. Information on such non-U.S. securities or related financial instruments may be limited. Non-U.S. companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in effect in the United States. The value of any investment or income from any securities or related derivative instruments denominated in a currency other than U.S. dollars is subject to exchange rate fluctuations that may have a positive or adverse effect on the value of or income from such securities or related derivative instruments.

The author of this communication is employed by Westpac and is not registered or qualified as a research analyst, representative, or associated person of WCM or any other U.S. broker-dealer under the rules of FINRA, any other U.S. self-regulatory organisation, or the laws, rules or regulations of any State. Unless otherwise specifically stated, the views expressed herein are solely those of the author and may differ from the information, views or analysis expressed by Westpac and/or its affiliates.

UK: The London branch of Westpac is authorised in the United Kingdom by the Prudential Regulation Authority (PRA) and is subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA (Financial Services Register number: 124586). The London branch of Westpac is registered at Companies House as a branch established in the United Kingdom (Branch No. BR000106). Details about the extent of the regulation of Westpac’s London branch by the PRA are available from us on request.

This communication is not being made to or distributed to, and must not be passed on to, the general public in the United Kingdom. Rather, this communication is being made only to and is directed at (a) those persons falling within the definition of Investment Professionals (set out in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”)); (b) those persons falling within the definition of high net worth companies, unincorporated associations etc. (set out in Article 49(2)of the Order; (c) other persons to whom it may lawfully be communicated in accordance with the Order or (d) any persons to whom it may otherwise lawfully be made (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this communication or any of its contents. In the same way, the information contained in this communication is intended for “eligible counterparties” and “professional clients” as defined by the rules of the Financial Conduct Authority and is not intended for “retail clients”. Westpac expressly prohibits you from passing on the information in this communication to any third party.

European Economic Area (“EEA”): This material may be distributed to you by either: (i) Westpac directly, or (ii) Westpac Europe GmbH (“WEG”) under a sub-licensing arrangement. WEG has not edited or otherwise modified the content of this material. WEG is authorised in Germany by the Federal Financial Supervision Authority (‘BaFin’) and subject to its regulation. WEG’s supervisory authorities are BaFin and the German Federal Bank (‘Deutsche Bundesbank’). WEG is registered with the commercial register (‘Handelsregister’) of the local court of Frankfurt am Main under registration number HRB 118483. In accordance with APRA’s Prudential Standard 222 ‘Association with Related Entities’, Westpac does not stand behind WEG other than as provided for in certain legal agreements (a risk transfer, sub-participation and collateral agreement) between Westpac and WEG and obligations of WEG do not represent liabilities of Westpac. Any product or service made available by WEG does not represent an offer from Westpac or any of its subsidiaries (other than WEG). All disclaimers set out with respect to Westpac apply equally to WEG.

This communication is not intended for distribution to, or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This communication contains general commentary, research, and market colour. The communication does not constitute investment advice. The material may contain an ‘investment recommendation’ and/or ‘information recommending or suggesting an investment’, both as defined in Regulation (EU) No 596/2014 (including as applicable in the United Kingdom) (“MAR”). In accordance with the relevant provisions of MAR, reasonable care has been taken to ensure that the material has been objectively presented and that interests or conflicts of interest of the sender concerning the financial instruments to which that information relates have been disclosed.

Investment recommendations must be read alongside the specific disclosure which accompanies them and the general disclosure which can be found here. Such disclosure fulfils certain additional information requirements of MAR and associated delegated legislation and by accepting this communication you acknowledge that you are aware of the existence of such additional disclosure and its contents.

To the extent this communication comprises an investment recommendation it is classified as non-independent research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and therefore constitutes a marketing communication. Further, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research.